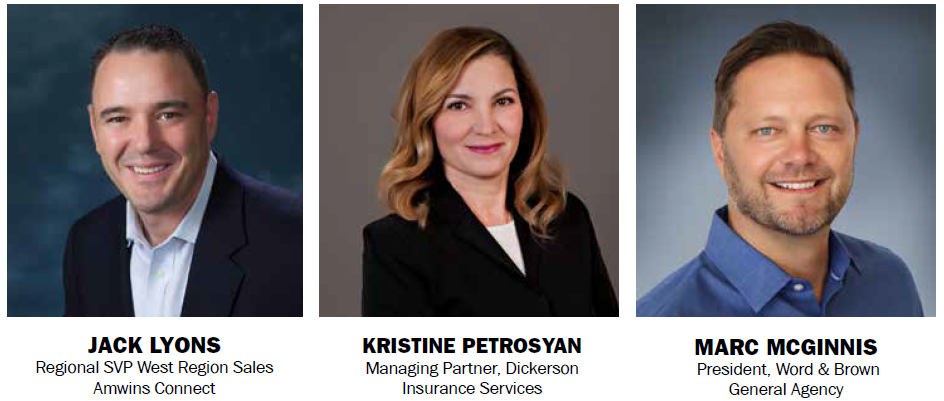

THREE EXPER TS SHARE PERSPECTIVE

Cal Broker got in touch with some of our favorite movers and shakers to find out the latest on General Agencies this year.

“We’ve greatly enhanced our communications so that brokers who work with us can be the most informed and prepared in the industry. ” — Jack Lyons

Cal Broker (CB): How has the ongoing pandemic impacted your business as a General Agent at this point?

Jack Lyons, Regional SVP West Region Sales, Amwins Connect:

Brokers have expanded their role as trusted advisors as employers navigate a sea change in the workplace. We’ve greatly enhanced our communications so that brokers who work with us can be the most informed and prepared in the industry.

That means providing key information through compliance briefs, our Connect Cast podcast series, our Coffee with Carriers video series, the Pulse newsletter, as well as webinars featuring industry experts. Our business intelligence team releases HR and compliance updates on a weekly, daily, and sometimes hourly basis.

For example, we’ve been working hard to prepare brokers for the new compensation transparency rules.

Sales support teams have stepped up with in-person, phone and digital support. They’ve helped brokers make the transition to conducting Zoom enrollment meetings and helped them communicate more effectively with clients and prospects in a whole new environment.

Kristine Petrosyan, Managing Partner and the Dickerson Insurance Services team:

Many companies have moved to operate virtually, and more people are moving out of state since they can work virtually anywhere. Finding solutions for companies with out-of-state employees is a common trend. During the first year of the pandemic, businesses shut down or were struggling on multiple levels adjusting to new restrictions and challenges. The second year of the pandemic was very different than the first. As we enter the third year, businesses expect that there will be COVID-19, but unlike 2020, they are not closing or shedding employees. It’s quite the opposite, there’s a huge labor shortage which is causing employers to do more and offer benefits in industries that previously never considered benefits to attract new employees or retain their existing employees.

The pandemic is continuing, but what is not continuing is a slow down in business. It’s full steam ahead, and brokers have more opportunity — not less. We see more quoting activity than we have ever seen, and a lot of it is from virgin groups.

“We are heavily invested in a complete digital transformation of our organization, and we’re already starting to experience significant efficiency gains as a result.” —Marc McGinnis

Marc McGinnis, President, Word & Brown General Agency:

The pandemic has afforded us the opportunity to find new and creative ways to work. We are heavily invested in a complete digital transformation of our organization, and we’re already starting to experience significant efficiency gains as a result. A remote deployment strategy is no longer uncommon. It will continue to be imperative to invest in technology systems, tools, and resources to ensure our employees have everything they need to be effective in their roles – and to address the needs of brokers and their clients.

CB: How can a GA most help agents in today’s climate?

Lyons, Amwins Connect:

GAs need to provide customized outreach to support brokers with the range of issues that employers are facing. We have a vital role in bringing world-class technology to help brokers compete and win against digital start-ups. We provide access to industry-leading tools for enrollment, administration, payroll and digital marketing. Ultimately, this focus has helped brokers build their business while delivering a better overall experience to clients.

Employers also need more support to keep up with compliance, which is always a moving target. A whole new set of issues are arising as employees plan return-to-work efforts including PPPs, COVID-19 testing and vaccines. We see this as part of our mission to help each broker become a one-stop-resource for their clients.

Petrosyan and Dickerson team:

We’re seeing a lot more activity in the industry. Having a GA Sales Rep is a key differentiator. As a GA, we are knowledgeable on carrier offerings in the small and large group market, and we can help brokers find the best solutions. It’s important to have our team act quickly and efficiently. We can support agents by strategizing with brokers regarding market opportunities and taking advantage of plans and underwriting.

Does the Sales Rep know how to put together creative packages? Carrier participation is down to 25%, and agents may not know how to mix and match carrier plans for ultimate savings and plan benefit. Is level funding or self-funding an option? What about captives? The GA will present and advise on a plethora of opportunities that did not exist even a couple of years back. A GA can help agents work smarter and more efficiently by offering online services like Ease and Zoom for presentations.

Having a reliable GA that provides the tools to assist with client presentations as well as keeping our brokers updated regarding carrier and industry changes is a huge benefit.

McGinnis, Word & Brown:

Brokers are looking to General Agents to be an extension of their servicing divisions. We will need to continue to handle servicing, quoting and enrollment, which so many brokers are struggling to find time/resources to support. We can also eliminate the account management and online enrollment burden for brokers and offer them new ways to enhance their value proposition. At Word & Brown, we’re committed to delivering a wide range of services to help the average broker reach new sales heights and achieve greater retention.

CB: What are your biggest concerns for the industry right now?

Lyons, Amwins Connect:

With remote work taking hold, many employers are challenged with providing benefits to employees in multiple states. There is also an increased focus on recruitment and retention. As a national GA, we’re perfectly positioned with local sales experts in multiple states, market-based solutions, and strong carrier relationships. With our most recent partnerships in New York, the Mid-Atlantic, and Arizona, we’re positioned to provide new levels of support to new markets.

Aside from the need for rapid digitization, our industry faces a new regulatory environment. It’s both a challenge and an opportunity. Our industry has not only adapted, but also thrived with every regulatory and legislative change that’s come our way. We’ve proven that we have an essential role in healthcare access. In fact, I think that brokers have become more essential in helping employers navigate the benefits landscape.

Petrosyan and Dickerson team:

Insurance premiums continue to go up with no end in sight to help bring them down. We are seeing more people going to Covered CA IFP with the hope for a subsidy rather than taking their group policy. Pharmaceutical companies continue to increase the cost of medication which contributes to the high cost of insurance.

“The pandemic is continuing, but what is not continuing is a slow down in business. It’s full steam ahead, and brokers have more opportunity — not less. We see more quoting activity than we have ever seen, and a lot of it is from virgin groups.” — Kristine Petrosyan

We are concerned with the challenges the state exchange is experiencing. While more and more employers

are signing up for health insurance, rates continue to outpace inflation. Everyone sees inflation at near 7% as an economic crisis, however, medical inflation is unsustainable. That’s why we see bills like AB 1400 come up, even though it got struck down. AB 1400 may be dead, but the idea of a single-payer health care system is not, so we need to make sure all Californians see it as a poor option.

McGinnis, Word & Brown:

The industry is facing many challenges. Technology companies continue to enter our space with the goal of creating greater efficiencies, sometimes falling short. Payroll firms are selling benefits administration platforms without understanding the market and potential connectivity/integration issues. Brokers are facing new legislation and compliance burdens, especially related to COVID-19 and employer/employee mandates. Talent poaching and retention are a challenge for agencies and clients. There is a trend toward brokerage mergers. Employees moving out of state have made it difficult to offer certain networks and meet carrier participation for California-based plans.