By Mike Wilbert

The last few years have turned the employee benefits space completely on its head at an unprecedented pace.

Employees, weary from the pandemic, have bounced from an uncertain job market to stimulus checks, to now a strong sense of concern around inflation and possibly a recession on the horizon. Employers were no exception.

From quick adjustments to working from home to the Great Resignation, all have a heightened focus now on human capital management.

The balancing act among macroeconomic trends, organizational culture, and employee wellness has never been more delicate, more uncharted, and more critical to maintain.

But with uncertainty comes opportunity.

Employee benefits have historically been viewed as a commodity. Most offerings were homogenous and not seen as something that moved the needle. Employees typically just looked at salary and retirement benefits and made their decision based on those upfront offerings.

This is a pivotal opportunity for benefits brokers to strengthen relationships, create long-term value, and address transformations happening with both workers and employers.

Great Expectations: New Employee Demands Pave Ways for Creative Benefits Solutions

Employers used to set the agenda with how, where and when employees worked. COVID-19 has since flipped that ideology on its head and inflation trends have added further challenges for both workers and employers. Organizations now face more challenges with recruitment and retention, due to workers having more leverage when it comes to how we work in a “post-pandemic” era.

Currently, the unemployment rate sits at a steady 3.6%, highlighting how workers have more employment choices than previously available.

While employment trends may be on the cusp of a seismic shift, workers still expect more from their employers, including voluntary benefits.

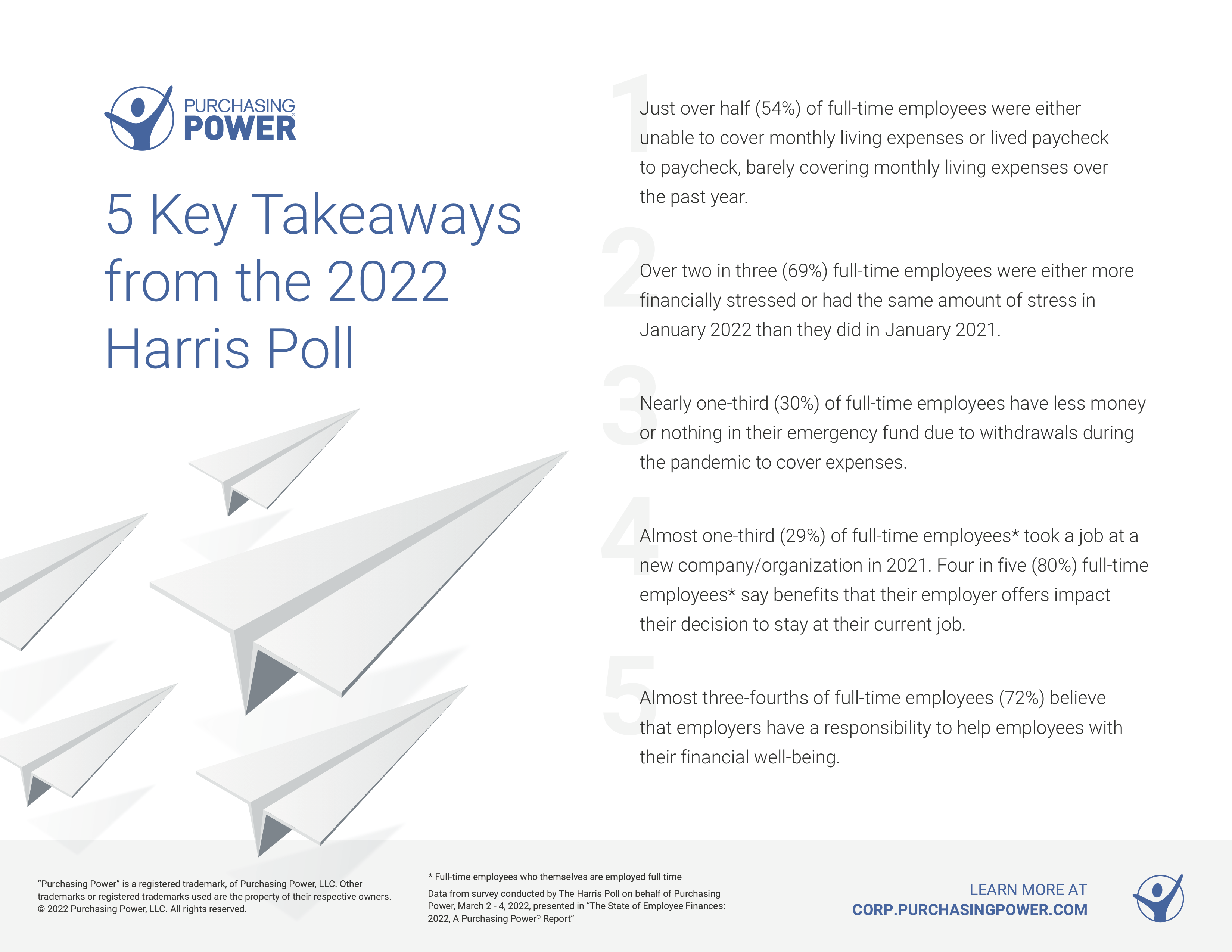

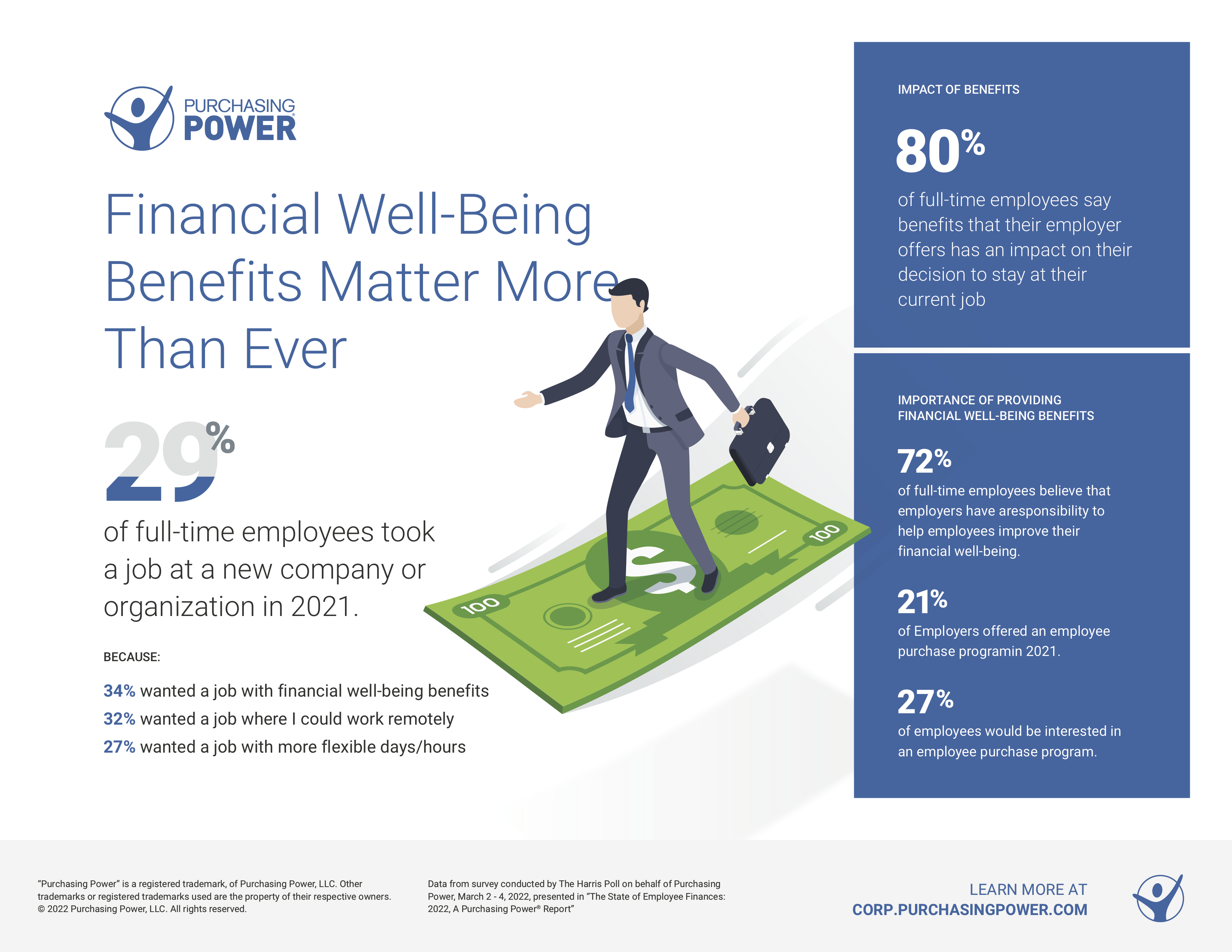

According to the recent Purchasing Power State of Employee Finances 2022 Report: in 2021 29% of full-time employees took a job at a new company or organization with 80% citing employer benefits impacting their ultimate decision to stay at their current job. Additionally, 72% of full-time employees believe that employers have a responsibility to help them improve their financial well-being.

In 2019, ahead of the pandemic, SHRM reported that 27% of U.S. employees would like their employer to provide additional support for mental health, including help coping with burnout (National Business Group on Health). Previous research indicates these trends may always have been top of mind; however, the emphasis has certainly amplified over the past two years.

These expectations from employees have now begun to drive noticeable changes from employers when it comes to enhanced benefit offerings to meet demand. Organizations are understanding the only plausible solution to satisfy employee needs is to effectively address their concerns by offering the right benefits.

For instance, the Purchasing Power State of Employee Finances 2022 Report shows employers began to heed this call with new voluntary benefits offerings that address practical financial needs and support. They include:

• Employee purchase program (21%)

• Financial counseling (20%)

• Medical deductible financing (18%)

• Bill payment programs (17%)

With current inflation surpassing 8% and average annual merit increases lodged between 2-3%, now more than ever before, employers are expected to offer voluntary benefits that help support the combined mental and financial health of the American worker. Especially if they expect to keep their workforce long-term as well as bring in fresh, new talent over time.

Benefits Packages: From One Size Fits All to a Custom Fit

In previous years, employee benefits offerings typically consisted of health insurance and retirement plans with little nuance for the different unique needs of employees. This “one size fits all” paradigm is outdated and should never return — and rightly so.

As we embark on a new era, the benefits landscape has exploded with options that have never been seen before, particularly financial empowerment opportunities. Brokers need to be aware of these benefits to present their clients with tailor-made offerings that can make all the difference with both recruitment, retention, and productivity.

Employee needs have drastically changed from both a cultural and social lens. The American workforce is battling a combination of financial, mental, and wellness factors that directly impact their day-to-day needs. For example, the typical American household is responsible for $5,111 in monthly expenses ($61,334 per year) with an average annual income of $74,949 (after taxes).

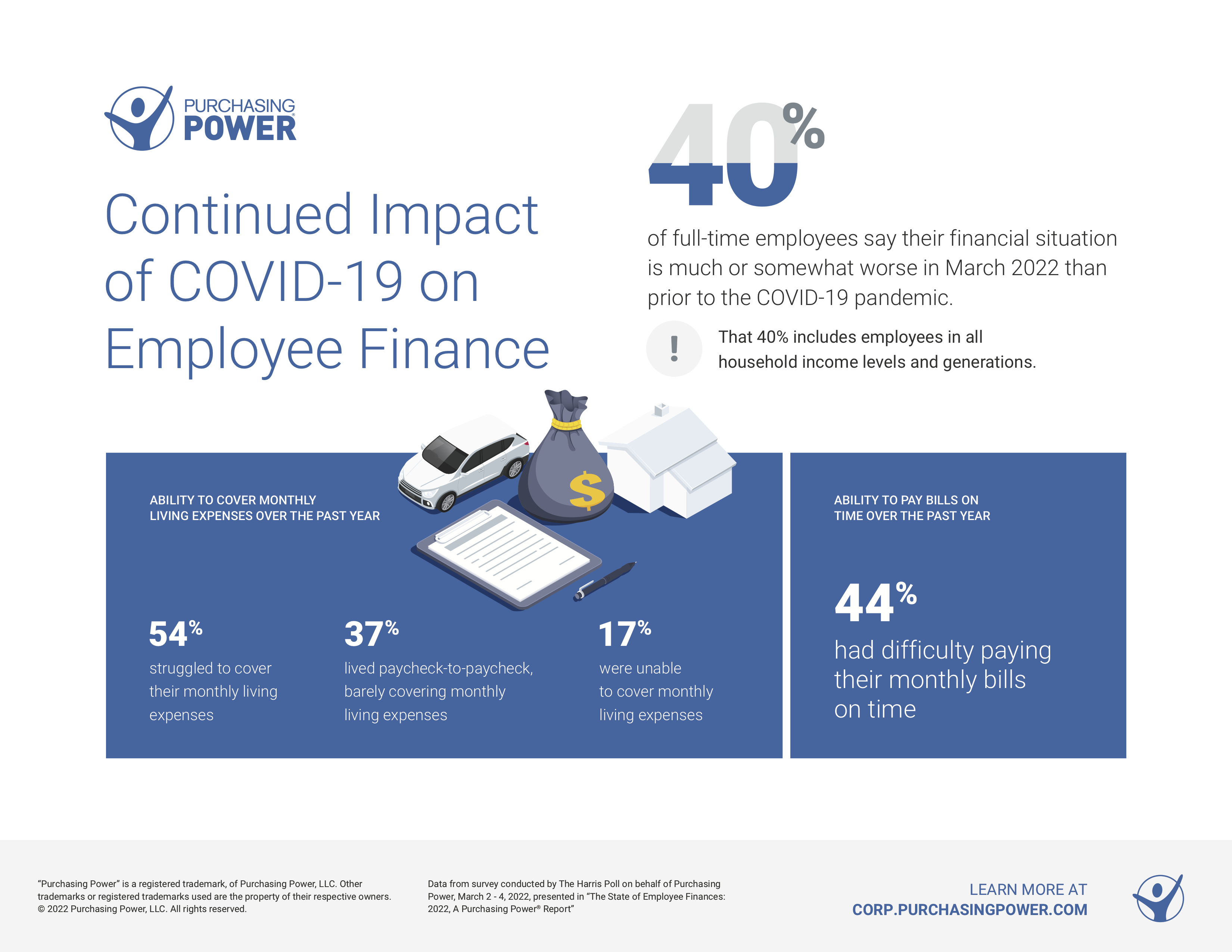

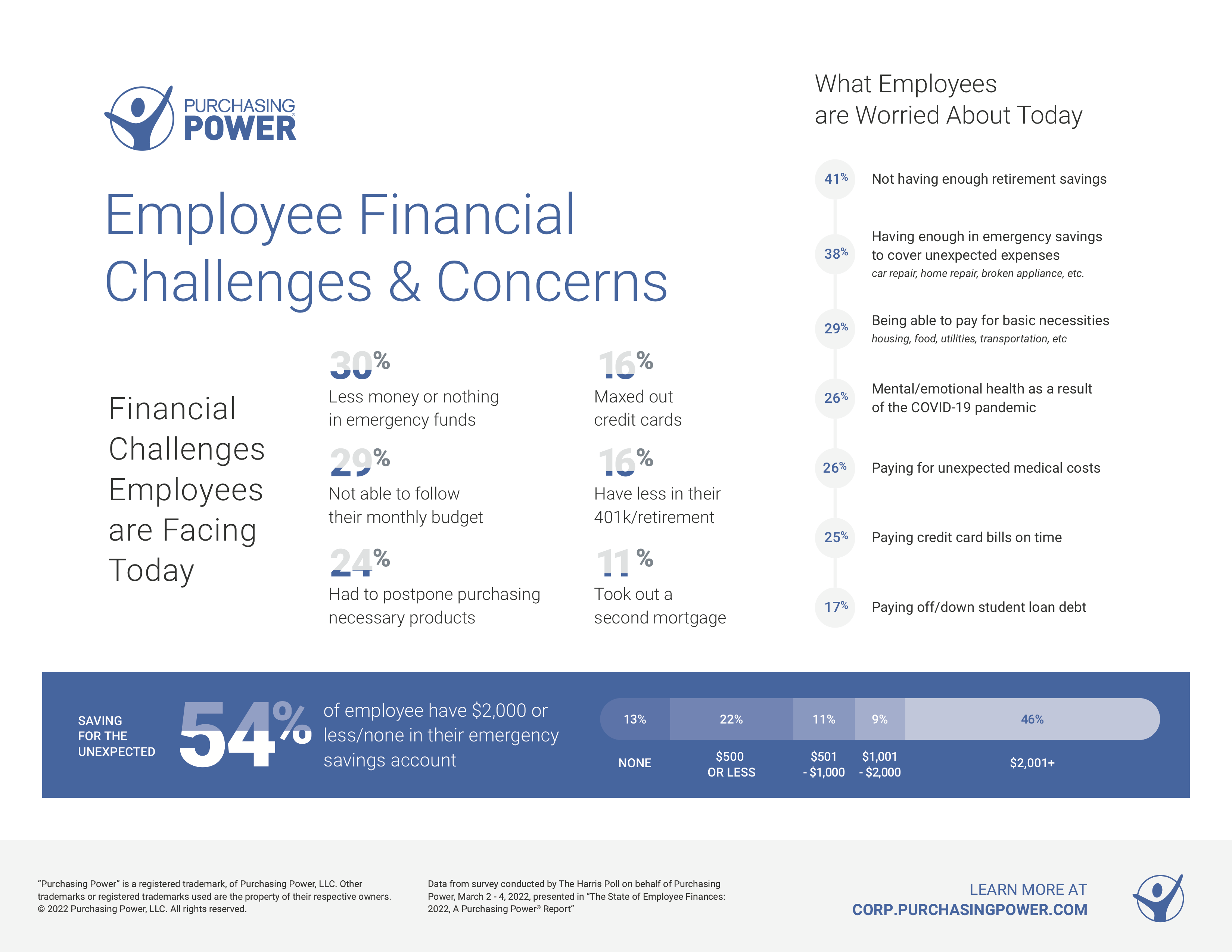

According to the Purchasing Power State of Employee Finances 2022 Report, if you continue to break down the numbers the situation becomes even more worrisome:

• 30% of full-time employees have less money or nothing in their emergency fund due to withdrawals during the pandemic

• 11% took out a second mortgage/home equity loan to cover monthly expenses which resulted in an additional monthly expense

• 16% have nearly or fully maxed out their credit cards due to overuse

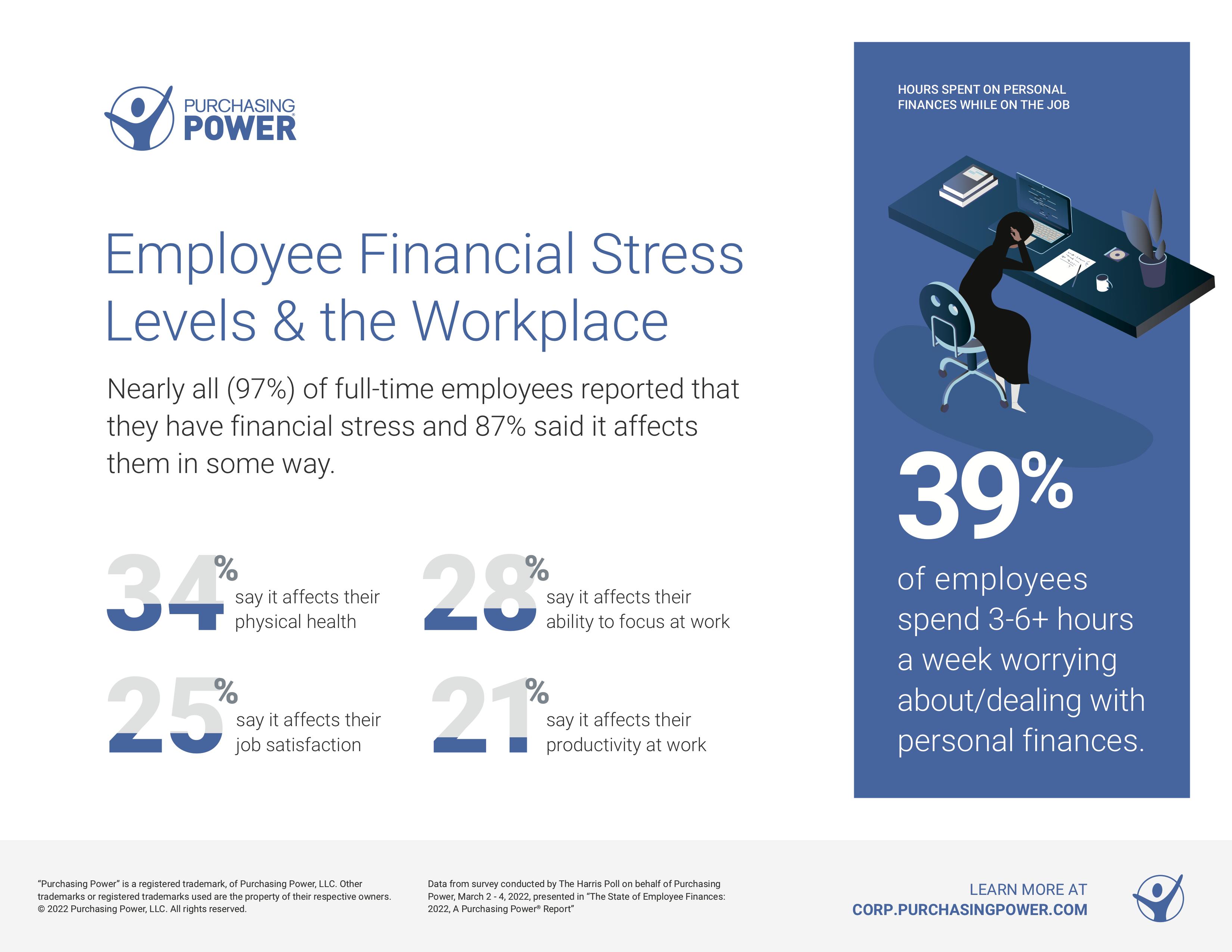

In addition to financial struggles, employees are facing an unprecedented hit on their mental and physical health as a direct result of monetary concerns. Again, citing the Purchasing Power State of Employee Finances 2022 Report:

• 97% of full-time employees report they have financial stress

• 87% said it affects them in some way (physical health, ability to focus, job satisfaction)

As the financial needs of employees continue to change and deepen, brokers are responsible for knowing this voluntary benefits landscape to ensure their clients are aware of what’s new and most valuable for them as an employer in the marketplace. Having the right package of benefits is essential to ensure organizations can offer employees customized offerings that fit their individual needs.

Client Relationships: Benefits Brokers Are Now Expected to Lead the Way

What has the rapid change meant for brokers? The role of a broker has evolved over the past decade, moving from tactical to strategic. Previously, there was a less hands-on approach and clients were okay with that because things functioned as status quo.

The pandemic and swarm of macro-economic trends accelerated this evolution.

Brokers are required to understand the breadth of the financial wellness benefits landscape to proactively advise their clients on what has changed, what is currently evolving, and how to adapt their plans to fit their workforce needs. If companies offer outdated or ineffective benefits options, not only will they miss out on attracting new talent, but they may also face a massive retention problem as workers will leave in droves to find other suitable and more attractive employment opportunities.

Ultimately, that responsibility falls into the lap of benefits brokers. According to a recent MetLife employee benefits trends report, top employer expectations of broker expertise include:

Recommending

• cost-saving alternatives (62%)

• product bundling to meet worker needs (59%

• new/innovative benefit solutions (58%)

While macro-economic trends on the horizon will no doubt continue to unfold, we ultimately find ourselves at an inflection point where employees now look to employers to support them with robust offerings and unique sets of benefits like never before.

Today, benefits brokers hold an important key to employer success and go far beyond just providing a menu of benefits offerings. They are a lifeline for organizations to make it out alive during a pivotal time that’s reshaping how we live and work.

MIKE WILBERT is Chief Revenue Officer at Purchasing Power®. In this capacity, he is responsible for leading affiliate client sales developed through direct and broker/partner relationships. He also oversees business-to-business marketing and account management for the company. Based in Atlanta, Wilbert reports directly to Purchasing Power Chief Executive Officer Trey Loughran.

With nearly 30 years of deep sales leadership experience within the benefits space, Wilbert most recently served as SVP of sales for Reliance Standard Life (RSL), a provider of group benefits including Life, Disability & Voluntary Benefits. Wilbert received his Bachelor of Business Administration from the Terry College of Business at the University of Georgia in Athens, GA. He also earned a Master of Business Administration from the Robinson College of Business at Georgia State University in Atlanta.

Contact: purchasingpower.com