Related article on retail healthcare delivery trend

Offer lower cost and greater convenience in higher-income areas, but rural and underserved are out of picture

Retail health clinics are growing not only in number but in scope of services delivered.

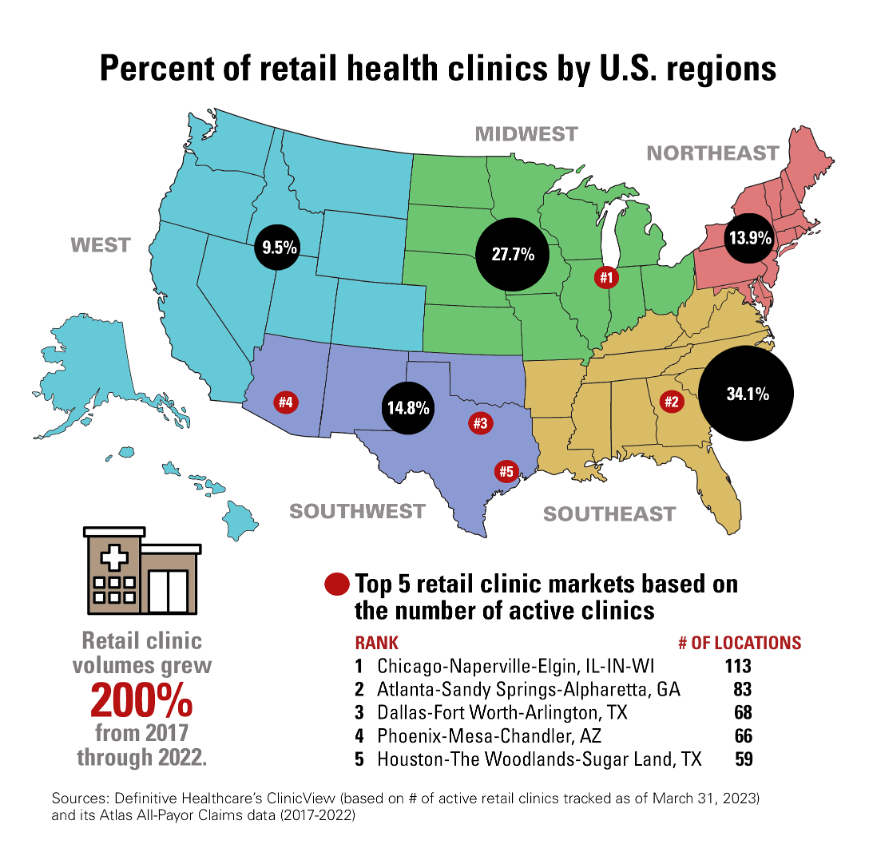

But so far, these outlets primarily are located in higher-income communities ringing urban areas with large populations while rural and underserved communities remain largely out of the picture. And as the need for COVID-19 vaccinations and related services continues to decline, retailers have been broadening their focus on primary care, specifically for those with chronic conditions, notes a recent Definitive Healthcare report. Insurance claims filed by retail clinics over the past five years have doubled and claims data from 2022 indicate that about one in 10 diagnoses at these outlets was related to a chronic condition like diabetes, chronic obstructive pulmonary disease, kidney disease and hypertension, the report states. Definitive Healthcare, which converts data, analytics and expertise into commercial intelligence, used its Atlas All-Payer Claims dataset to understand the types of diseases retail clinics are treating.

A Vast Opportunity for Retailers

Just how quickly retailers like CVS Health, Kroger, Walgreens and its partner VillageMD and others can grow their presence in these areas and with traditional providers could determine how

significant their long-term relationships will be with consumers. The opportunity for retail clinics to become meaningful players in chronic disease is vast, especially as these locations expand their

focus from episodic treatment to primary care.

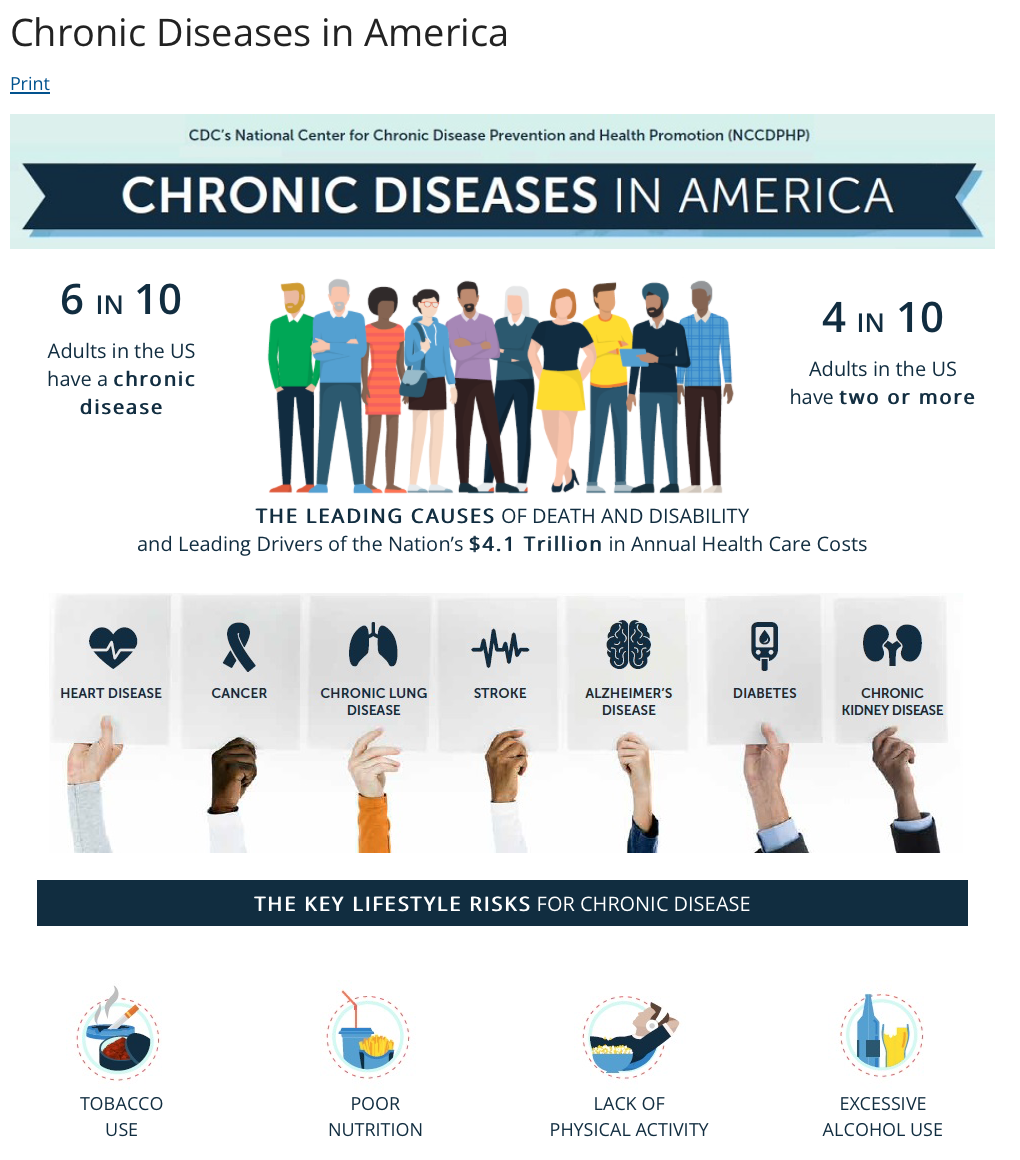

Centers for Disease Control and Prevention (CDC) data illustrate the opportunity.

The CDC reports that more than 60% of Americans are living with a chronic disease and four in 10 Americans have two or more, becoming the leading causes of death and disability and key drivers in the nation’s $4.1 trillion in annual health care costs.

What’s driving many patients to retail clinics is predictable: lower cost and greater convenience, the report concludes.

Big Retailers Dominate the Market

About 85% of retail clinics are owned by large retail chains like CVS, Kroger, Walgreens and Walmart, Definitive Healthcare states. In recent years, however, some hospitals and health systems have entered the retail landscape by partnering with chains, such as Kaiser Permanente’s partnership with Target stores in Southern California.

● Pharmacy giant CVS is by far the biggest player in terms of market share (63%), based on the number of locations.

● Kroger Health, a division of the supermarket giant The Kroger Co., is the second-largest operator at 12% market share through its Little Clinic business, which it acquired in 2010, and operates more than 220 retail clinics in 35 states.

● VillageMD, majority-owned by Walgreens, is the third-largest operator with 8% of the market, followed by Advocate Health with 3%. 3 Takeaways from the Report 1 | Be open to partnerships with retailers.

1 | Be open to partnerships with retailers.

With retail clinics becoming an increasingly popular destination for consumers, it behooves traditional providers to develop a relationship with them, the report suggests, adding that

traditional providers have some inherent technology advantages.

Takeaway #1

Regardless of how a partnership is structured, a robust information technology structure that supports care coordination between partners is essential to success. To ensure consistent care, clinical protocols for conditions treated at retail clinics should be embedded in electronic health record systems, alongside established processes to drive

referrals to health system-affiliated primary care physicians.

2 | Emphasize your commitment to all communities served.

Retail clinics are widespread and easily accessible to large portions of the population, but they do not appear to be improving access to care for underserved populations due to their locations.

Takeaway #2

Most retail clinics operate in geographic areas with higher median incomes, in part to attract — or respond to demand from — a more affluent patient mix, the report shows, noting that

areas with retail clinics tend to have a higher concentration of white residents, fewer Black and Hispanic residents and fewer people living in poverty compared with the national average. Hospitals and health systems, on the other hand, can trumpet their commitment to serving all communities.

3 | Evaluate health system retail-ownership models.

As hospitals and health systems pursue mergers and acquisitions to strengthen their positions in certain markets, some organizations may want to consider acquiring or starting their own retail clinics, the report suggests. Also, retailers may want to divest some of their retail clinics, as Walgreens did when it shuttered about 160 retail clinics in 2019. The company shifted ownership and operations to several health systems, including Advocate Health in Chicago and Atlanta-based Piedmont Healthcare.

Takeaway

Health care systems have strong local brands, nurse practitioners to staff clinics and physicians for oversight. They also can generate demand within the communities they serve based on trust. Any health system pursuing this strategy should have direct experience in operating a retail like clinic, such as community primary care clinics or employer worksite clinics, the report cautions.

Republished with permission, AHA Market Scan 2023. www.AHA.org.

Register online to receive free AHA newsletter: https://www.aha.org/center/form/innovation-subscription