Here’s what we’ve been hearing lately:

Open enrollment was grueling. Health insurance law is dizzying. Your commissions have changed.

Yet …

you’re still here!

So thank you. Thank you for bringing access to health care to the people. And thank you for being loyal to Cal Broker and Insurance Insider Newsletter! No matter what, we love to hear from you: editor@calbrokermag.com

AM Best: Health Insurers Doing Well

Who hoo! AM Best says it’s maintaining a stable market segment outlook for the U.S. health insurance industry in 2019, citing positive earnings in all major lines of business, growth of industry capital and surplus and reduced near-term regulatory uncertainty. The new Best’s Market Segment Report, titled, “Market Segment Outlook: U.S. Health,” contends that positive fundamentals continued in 2018 driven by favorable medical cost trend, stable performance of the commercial group market, profitable growth in government programs and sustained improvement in the commercial individual segment. AM Best expects underwriting results to be strong in 2018, though down slightly compared with 2017 (when the industry reported its highest earnings in five years!). Best says carriers are pricing closer to medical cost trends in the current year, especially in the individual business where profitability exceeded projections for many carriers in 2017. Strong earnings are expected to contribute to further growth of capital and surplus, which — similar to 2017– outpaced premium growth. Government programs remain the industry’s primary source of premium growth, driven by Medicare Advantage and Medicaid managed care. Want to know more? Go here to access a copy of the full report.

5 Tips for Clients looking to help reduce health care costs

Robert Falkenberg, CEO, UnitedHealthcare California, says now is the ideal time to teach your clients how health plans work and how they can use them to their economic and health advantage. Here are Falkenberg’s five top tips:

- Understand the health plan

It sounds basic, but understanding the health plan before clients need to use benefits can save you a lot of time, stress and money. They need to learn what their health plan covers – including medical, pharmacy and preventive benefits. When in doubt, tell them they can call the number on the health plan ID card to get the most up-to-date information.

Also, it’s a good time to make sure they understand health plan terms such as deductible, copay, coinsurance and out-of-pocket limit. If they need a refresher, there are resources online such as the Just Plain Clear Glossary to help them learn and understand these terms.

- Ask about lower-cost prescriptions

If clients are worried about the cost of a medication, mention those concerns to their doctor who might be able to find a more affordable option. Many doctors are now using technology that enables them to view precise medication costs in real time before leaving the exam room. In addition, some pharmacy benefit plans now offer discounts at the point of sale by providing savings from pharmacy manufacturer rebates directly to consumers. These discounts could potentially lower your out-of-pocket costs on select medications.

- Stay “in network”

Make sure clients understand that one way to help keep costs down is to stay in a health plan’s care provider network, which consists of the doctors, specialists, hospitals and other care facilities.

- Consider alternatives – even online docs

For nonemergency issues, clients might be able to receive fast, professional and lower-cost care at an urgent care center, a convenience care clinic or an online doctor visit. Online doctor visits are a great option for treating conditions such as colds, migraines and allergies. Online visits often can cost as low as $40 or $50 per visit, much less than a trip to urgent care or an emergency room.

- Take advantage of wellness discounts and incentives

Encourage clients to explore employer and health plan incentives for taking healthier actions such as completing a health survey, exercising or meeting nationally recommended health benchmarks for cholesterol, blood pressure, body mass index, and no nicotine.

Walmart and CVS Reunited

Last week we reported on the Walmart-CVS split. This week the two are back together and it looks like it’s now a long-term commitment. CVS Health and Walmart announced the companies have reached a multi-year agreement on terms under which Walmart will continue participating in the CVS Caremark pharmacy benefit management (PBM) commercial and Managed Medicaid retail pharmacy networks. The companies are not disclosing the financial terms of the new contract. Well, okay!

Walgreens Disappoints and Pays For It

This is really irritating… Walgreens Boots Alliance Inc. has agreed to pay $269.2 million to settle U.S. claims that the drugstore chain defrauded Medicare and Medicaid over insulin drugs and a consumer-discount initiative. The two settlements, announced this week, are a result of allegations over improper billing. In the first, Walgreens agreed to pay $209.2 million to resolve claims it billed Medicare, Medicaid and other programs for hundreds of thousands of insulin pens it distributed to people who didn’t need them. In the second, Walgreens said it would pay $60 million for overbilling Medicaid by not disclosing lower drug prices it offered in a discount program. What is wrong with the people at Walgreens!?? Have they no conscious or shame or sense of responsibility to the American taxpayer? Don’t answer that.

Campaign Against Insuring Coal Chugs On

When we first heard about this campaign against insurers who insure coal and/or invest in the coal industry, we thought it might be a passing thing. Nope. These people are serious and diligent. Take a look at the latest email we received…

Dear colleague,

The Unfriend Coal campaign calls on insurance companies to stop underwriting and investing in climate-destroying coal projects. Our electronic newsletter, Insuring Coal No More, shares brief updates and campaign highlights on climate, coal, and the insurance industry on a monthly basis. The January issue, which will appear tomorrow, will focus on the role of insurance brokers in facilitating coal projects, on initial movement on coal among US insurers, and on the manifold impacts of the California wildfires on insurers. You can sign up at https://unfriendcoal.com/newsletter/ to subscribe to this free monthly newsletter.

Regards,

Peter Bosshard

Director, Finance Program

The Sunrise Project

Coordinator, Unfriend Coal campaign

So, if you feel like, sign up for the newsletter and see what they’re up to. We did.

A Must-Read for Life Agents

Listen up, life insurance folks. The IRS (we guess they’re working during the shut down?) has released final regulations that should help life agents get a new federal income tax deduction. The IRS says it generally will exclude sales of commission-based insurance policies when deciding whether a business owner can qualify for the “qualified business income deduction.” So that’s a win. For more info, read this post by ThinkAdvisor’s Allison Bell.

More Employees Than Ever Test Positive for Pot

Recent research by Quest Diagnostics shows plenty of employees are availing themselves of marijuana: there’s been a 33 percent increase in positive drug tests on employees. According to Rob Wilson, president of Employco USA, a national employment-solutions firm, the increase in employee usage of marijuana is in industries across the board. In California and nine other states it’s legal to use marijuana for recreation, and in 33 states it’s legal to use medically. With this in mind, employers may wonder what rights they have when taking a hard line on drug use.

An employer’s ability to monitor employee drug use depends on whether or not the organization is unionized. In a non-union environment, a supervisor or human resources team member can help determine if an employee is under the influence of marijuana. “If your suspicions are backed up by other leaders in your company, you can discipline and even terminate your employee,” says Wilson.

If you work in a collective-bargaining workplace, Wilson says that you should have a series of steps laid out in your handbook that will help everyone understand what the outcome of marijuana use on the job will be. Even though marijuana law are changing, employers can still have a zero-tolerance policy about drug use on the job — even if the employee has the legal right to use marijuana. However employers can’t, for example, discriminate against someone simply because they have a medical marijuana card.

Hodges-Mace Launches SmartBen® Bridge Program to Enhance the Customer Experience

Hodges-Mace announced the launch of the SmartBen Bridge program for benefit partners and vendors. Bridge offers a partnership where stakeholders involved in the lifecycle of a client can connect to provide a better benefits delivery experience for their mutual clients. The company says Bridge is the culmination of extensive research and analysis into how Hodges-Mace, with the help of its partners and vendors, can best serve the growing needs of its customers and brokers. The new program is designed to educate the market about the software and services that Hodges-Mace brings to the table and how the organization interfaces with various providers to deliver smarter benefit solutions. Hodges-Mace currently has an extensive network of partners including brokers, carriers (both medical, and group/VB), payroll/HRIS firms, and value-added companies (i.e. FSA / COBRA / telemedicine, etc.). The company also works with a variety of vendors to help employers and their employees maximize their benefits coverage. Bridge takes all the disparate pieces of information from stakeholders and packages them into a smart, online tool to improve the employer/employee experience.

IICF To Honor Lockton’s Timothy J. Noonan

The Insurance Industry Charitable Foundation announced it will honor Timothy J. Noonan, president and CEO of Lockton Insurance Brokers, with the Golden Horizon Award for leadership and philanthropic commitment. The honor will be bestowed on Noonan March 21 at the South Park Center in downtown Los Angeles. Visit the IICF website for more info.

PIMA’s 2019 Industry Insights Conference

January 24-27, 2019, Margaritaville Beach Resort, Hollywood, Florida

Registration is now open for the Professional Insurance Marketing Association (PIMA) Industry Insights Conference. The conference will host expert speakers from leading companies around the country including Facebook, Forrester and Action Surge. Conference promises to explore new product and distribution trends; emerging markets that harness growth in new areas; social marketing to drive insurance business; marketing to Millennials and Gen Z; and an insurance industry overview of blockchain. Early bird registration and housing deadline is December 14, 2018. Visit PIMA’s conference page for more details and to register or call 817-569-7462 (PIMA).

BenefitsPRO Broker Expo

April 2-4, 2019, Hyatt Regency, Miami, FL

A leading educational and networking event for employee benefits brokers and agents. Cultivate important relationships and obtain the most practical industry education for positioning your business for sustainable growth. More info here.

LAAHU Annual Conference

April 17, 2019, Skirball Cultural Center, Los Angeles. Register here. Exhibitor info here. Sponsorship info here.

LAAHU’s Annual Conference is the largest in the state and includes updates from D.C., breakout sessions for IFP, small group, large group, medicare and more!

IICF Casino Night

May 16, 6-10p.m. San Francisco

Register here.

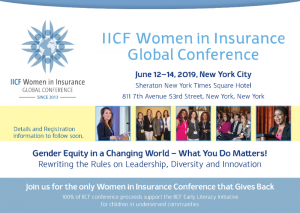

IICF Women in Insurance Global Conference- save the date!

June 12-14, 2019, New York City