‘State of Coronavirus and Insurance Report’ A Must-Read

InsuranceQuotes.com recently released its State of Coronavirus and Insurance Report. The report provides an analysis of COVID-19’s effect on:

- Health insurance

- Travel travel insurance

- Unemployment insurance

- Business insurance

- Restaurant insurance

- Special events insurance

- FIlm/TV/production insurance

- Auto insurance

Author Michael Giusti says that most insurers had been preparing for a pandemic for roughly 18 years. According to Giusti:

…following the SARS epidemic in 2002, nearly every line of insurance coverage began writing in clauses that excluded pandemics and infectious disease causes, protecting many insurers from having to pay out claims in a time like this.

Giusti also predicts what’s ahead in the coming months and years. Read the whole report here.

Insurance Pros Honor ER Staff

Careful readers of Insurance Insider News might remember we mentioned a couple of Los Angeles area insurance pros doing a good deed for Providence St. Joseph’s Hospital in Burbank last week. But we didn’t have photos! So here are some shots of John Antonioli with Ross Pendergraft and colleagues at Providence St. Josephs Hospital. They provided 100 Firehouse Subs lunches to the ER staff!

Aflac Supports Frontline Workers in Distress

Aflac recently announced a $1 million donation to Crisis Text Line. A global, not-for-profit organization established in 2013 and specializing in mental health intervention, Crisis Text Line provides free, 24/7, confidential support to people in crisis via SMS texting. Aflac’s donation will help fund the organization’s new campaign, For the Frontlines, aimed at helping individuals battling the COVID-19 crisis in the U.S.

Have you seen the recent back covers of California Broker magazine?

Many insurance companies have proved it not so difficult to come up with memorable ads for the consumer. But writing good copy for business-to-business purposes is far more challenging. Good job, Word&Brown.

LIFE

LIMRA, the Society of Actuaries and TAI Announce Joint Research Project to Examine COVID-19 Impact on Mortality

LIMRA, the Society of Actuaries (SOA) and TAI have partnered on a joint mortality experience study that will compare individual life mortality involving COVID-19 now and into the near future. The organizations are currently working on an inaugural report to release later this summer. This experience study will make use of the individual life insurance data stored in the TAI Reinsurance Administration system, which includes over 90 percent of the top 50 life insurers in North America. Leveraging this data will help provide a faster and more consistent data collection process and will reduce the burden on insurers to find resources to compile data. The findings should help provide timely, meaningful data to help SOA members manage individual life insurance mortality risk through COVID-19. More info here.

FINANCIAL PLANNING

Deep Confusion in PPP Land

ThinkAdvisor reports that financial folks, including CPAs, are extremely frustrated by the conflicting information they are being given about the Payroll Protection Program’s loan forgiveness guidelines. It looks like guidance doesn’t add up and, to make matters worse, it also keeps changing. Read the whole story here.

MEDICARE

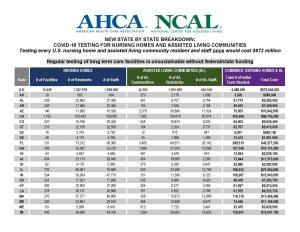

Cost Estimates Come in for COVID-19 Testing for Elderly and Caregivers

The American Health Care Association and the National Center for Assisted Living now say that to test every U.S. nursing home and assisted living community resident and staff once for COVID-19 would cost about $672 million. In California alone it would cost more than $68 million. Download the PDF of the state by state chart here.

More Time for Medicare

People who were unable to enroll in Medicare during the normal enrollment periods due to the COVID-19 pandemic, now have extra time. California Health Advocates and others were integral in advocating for this time. The extra time, referred to by CMS as “equitable relief”, is for enrolling in Medicare Part B, premium-free Part A or refusing automatic Part B enrollment. People may be eligible for this equitable relief if they were unable to enroll in Medicare Part A or Part B because of delays and problems accessing the Social Security Administration to file an application or enrollment, as a result of the unexpected, pandemic-induced closure of field offices. This extra time/equitable relief is retroactive to March 17, 2020 and extends 3 months through June 17, 2020.

DRUGS

Specialty Drug Maximizers Get Scrutiny

Adam Fein at Drug Channels has a post up stamped “top secret.” Fein says:

The two largest PBMs—CVS Health’s Caremark and Cigna’s Express Scripts—have each partnered with secretive and independent private companies to operate specialty drug maximizer programs for their plan sponsor clients. What’s more, at least one of these private companies earns fees equal to 25% of the manufacturer’s copay support program.

You should probably read the whole post. It’s here.

SELF INSURANCE

EVENTS

- Don’t forget LAAHU’s Zoom Happy Hour Today 4 p.m.

This is an excellent way to stay connected to colleagues. Register here.

- The National Association for Fixed Annuities Webinar

Elder Financial Fraud in the COVID 19 Environment

Thursday, May 28, 2020

8:30 a.m. PT

- IICF Dialogue on Diversity

Insurance Industry Charitable Foundation is offering Dialogue for Diversity Live! June 25 at 1 p.m. PT. More info and registration here.

- NAAHU Annual Convention will be Virtual in June

National Association of Health Underwriters announced its annual convention will now be virtual and take place on June 28-30, 2020. More info at NAHU’s website.

- LAAHU Annual Sales Symposium will be Virtual in July

LAAHU’s AdapTech annual conference will now be virtual on Friday, July 17, 2020. More info at LAAHU’s website.

- IICF Foundation Women in Insurance Regional Forums Rescheduled

Insurance Industry Charitable Foundation has rescheduled the Women in Insurance Regional Forums:

New York: October 26

Los Angeles: October 30

Dallas: November 17

- 16th Annual BenefitsPRO Broker Expo 2020 goes forward with August 20-22 date

BenefitsPRO Broker Expo 2020 says the show will go on August 20-22 in Austin, Texas. More info here.

- CAHU Women’s Leadership Summit Now Rescheduled for March 2021

CAHU’s WLS committee announced that the second Women’s Leadership Summit has been rescheduled for March 24-26, 2021, at the JW Marriott in Las Vegas. Questions should be emailed to info@cahu.org.