It’s another beautiful May day in California and all you have to do is click on one of the items below for a nugget of info about the insurance, financial planning and employee benefits industries. So that’s kinda cool.

NEW TECH FOR EMPLOYEE LEAVE

Guardian Life Launches New Absence Management Program

According to Guardian’s Absence Management Study, 82% of employers report difficulty keeping up with changes to federal and state leave laws. And eight in 10 employers say COVID-19 raised company awareness of the problem. Looks like Guardian has come up with a solution. The company announced a new absence management offering, Guardian Absence Solutions, for companies seeking to simplify their employee leave programs. The new tech provides a guided, comprehensive absence management experience that supports optimal return-to-work outcomes for employees, while addressing the growing compliance challenges.

To create Guardian Absence Solutions, Guardian partnered with EIS, an insurance software company with an API, cloud-native product platform. The new digital platform integrates EIS’ software with Guardian Life’s absence management platform to modernize the leave experience with a customized interface that includes mobile and digital omnichannel communication capabilities.

Lastly, if you’d like to know more, Guardian Life is hosting a webinar titled “Improving Employee Leave” on Wednesday, May 26 from 9- 10 a.m. PT. Register here.

CALSAVERS INFO

Tap Into CalSavers Expertise

ADVISERS WHO WANDER

Hot on the Case of the Wandering Adviser

New York University School of Law researchers Colleen Honigsberg, Edwin Hu and Robert J. Jackson, Jr. recently wrote a paper on wandering financial advisors. That’s the term they’ve come up with for a financial advisor who gets into trouble in one sector of business but retains — or even expands — licensing in another sector. ThinkAdvisor has a story up about it. But we’ll cut to the chase for what you need to know:

…of those wandering advisors who… leave the brokerage industry after serious misconduct, the majority…continue to work as state-registered insurance producers.

So, obviously, that’s rather interesting. Especially when you learn from the research that producers who have had problems in one area are the ones who tend to also have misconduct in the insurance arena. Lawmakers have been hyper focused on protecting the public against bad financial advice, but this the first time anyone has looked into the phenomenon of bad actors simply moving their productions. Here’s what the researchers ultimately recommend:

Our findings provide insights for the commentators and lawmakers now debating the future regulation of financial advice. We argue that the case for a single unified database of financial advisors is especially strong. We contend that strengthening mechanisms for regulator accountability could help address the costs imposed by wandering financial advisors. And our findings suggest that insurance firms could play a more meaningful role in monitoring advisor misconduct.

HEALTH INSURANCE EDUCATION

Great App to Educate Younger People About Health Insurance

We all know that it’s important to understand health insurance basics in order to participate in our healthcare system. Yet results from national studies on health insurance comprehension consistently demonstrate information gaps especially among younger enrollees. And efforts to empower young consumers by advancing health insurance literacy haven’t worked very well.

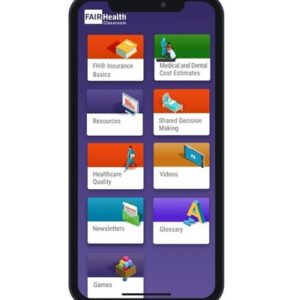

The national, independent nonprofit FAIR Health is trying to fix this. The organization recently launched FH Consumer Classroom, a free mobile app available to colleges and universities to equip students with practical skills needed to make informed health insurance choices.

The app enables users to learn about health insurance and healthcare quality through articles, videos and a glossary, and access key resources and interactive puzzles and games to support learning. The app also links to FAIR Health’s nationally recognized FH® Medical and Dental Cost Lookup Tools, which enable consumers to estimate the typical costs of medical and dental procedures.

Colleges and universities can use FAIR Health’s free app to promote health insurance literacy on campus and advance a generation of informed healthcare users.

Spread the word…instructors can download FH Consumer Classroom here: Apple App Store or Google Play. This is one of those things that seems so wonderful and useful and yet we imagine college students would only access this info if a professor made them!

INDUSTRY CLIMBERS

Sutter Health Aetna and Aetna Team Particpates in 2021 Leukemia and Lymphoma Society Big Climb SF

Bravo to the more than 60 employees, family and community members of Sutter Health | Aetna and Aetna® who joined forces to raise a total of $19,853.00 for the 2021 Leukemia and Lymphoma Society Virtual Big Climb San Francisco. The annual event, co-sponsored this year by Sutter Health | Aetna and Aetna, brings Northern California corporations and community members together to climb the equivalent of San Francisco’s iconic Salesforce Tower, a total of 1,762 steps, while raising thousands of dollars to help fund lifesaving blood cancer research. Combined, the Sutter Health | Aetna team climbed about 105,720 flights of stairs for charity!

CAL DENTAL HEARTS GAVIN NEWSOM

Cal Dental Assn Says Newsom is the Man

The California Dental Association wishes to commend Gov. Gavin Newsom for a May revision budget proposal that the organization says shows his strong commitment to greater equity and access in the Medi-Cal Dental Program as well as economic recovery from the pandemic. According to CDA:

The governor deserves enormous credit for lifting the 2022 sunset date for Proposition 56 supplemental Medi-Cal provider reimbursements and for proposing to discontinue the failed Medi-Cal Dental Managed Care pilot program. Despite significant improvements and investments in Medi-Cal since 2016, the DMC plans continue to lag behind the rest of the state in every measurable metric. In 2019, only 40.5% of Sacramento children in Medi-Cal visited the dentist, a full 10% lower than the statewide average. And even within the same county, DMC underperforms: Los Angeles’ optional dental managed care for children had a utilization rate that was 9 percentage points lower than L.A. fee-for-service in 2019 (52.4% versus 43.6%).

CDA also wholeheartedly applauded the $230 million Gov. Newsom’s budget provides to the CalAIM Dental Improvement Program, the removal of the sunset date on Medi-Cal adult dental benefits and the investment of $115 million for workforce development, including for allied health care professions, creating entry into careers such as dental assisting. So it looks like there are a few Newsom fans out there.

INTERNATIONAL SUMMIT FROM COMFORT OF HOME

Insurance Industry Announces Free IDF Summit 2021 June 7-8

The Insurance Development Forum (IDF), a public-private partnership led by the insurance industry and supported by international organizations, announced the inaugural IDF Summit 2021 taking place virtually on June 7-8. The theme is “Building Resilience in a Risker world: Actions towards a climate resilient future”. The event, which is free to attend, will feature speakers from AXA, Zurich Insurance and other companies and organizations, including:

- H.E. António Guterres, Secretary General, United Nations

- Denis Duverne, Chairman, AXA & Insurance Development Forum

- David Malpass, President, World Bank Group

- Kristalina Georgieva, Managing Director, International Monetary Fund

- Mark Carney, UN Special Envoy for Climate Action and Finance & UK Prime Minister’s COP26 Finance Advisor

- Hon. Waldo Mendoza Bellido, Minister of Economy & Finance, Republic of Peru

- Achim Steiner, Administrator, UNDP & Co-Chair of the IDF SteerCo

- Michel Liès, Chairman, Zurich Insurance Group & Deputy Chair IDF SteerCo

Get more info about IDF here. Register for the IDF Summit June 7-8 here.

PEOPLE

AmeriLife Welcomes Bob Yates

AmeriLife Group has hired Bob Yates to fill the new role of vice president, Distribution, Analytics and Data at the corporate headquarters in Clearwater, Florida. In this role, Yates will partner with AmeriLife’s data science and data engineering teams to develop, launch and manage new enterprise analytic products to support distribution channels.

EVENTS

- CAHU Capitol Summit, Virtual, May 17-19, Info here.

- NAIFA-LA , Building Business Insights (4 advisors/agents share their wisdom on creating a stronger business), Virtual, May 20, Register here.

- NAAIA Agent Round Table Discussion: Why Should I Join? – Exploring the Value of Professional Trade Associations for Black Agents, May 27, Noon PT, Register here.

- IDF Forum, Virtual, June 7-8. Register here.

- IICF International Inclusion in Insurance Forum, June 15-17. Register here.

- NAHU Annual Convention & Grow Your Business Exp, theme is “The Path Forward”, Virtual, June 27-29, info at nahu.org.

- BenefitsPro Broker Expo, in person in San Diego, August 16-18. Save 15% with promo code RIGHTPLAN. Agenda here, register here.

- American Association for Medicare Supplement Insurance, National Medicare Supplement Insurance Industry Summit, Sept 8-10, Schaumburg Convention Center, Chicago area. Info here