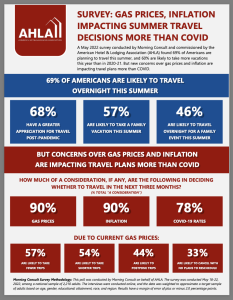

The American Hotel & Lodging Association commissioned a survey conducted by Morning Consult that revealed that U.S. citizens are more concerned about gas prices and inflation than COVID-19 when making their summer travel plans. Here’s their infographic full size.

TRAVEL

What now? Monkeypox??

Traveling abroad now has a NEW risk – Monkeypox! But according to President Biden, the risk is very low, and we have enough smallpox vaccines to address the problem. There is little concern — despite the media swirl — according to Jennifer McQuiston, deputy director of the CDC’s Division of High Consequence Pathogens and Pathology. As of this writing there are only 10 confirmed cases in the U.S. from May 13 to May 26, the World Health Organization (WHO) said — all from traveling abroad.

The WHO expert said more than 250 cases of monkeypox have been confirmed around the world over a two-week period, but a pandemic is unlikely.

For the latest, listen or read stories: NPR, Washington Post, USA Today and Reuters

PANDEMIC NEWS

Annual COVID-19 shot being considered

Yearly fall flu vaccinations may be paired with COVID-19 shots to protect susceptible individuals against hospitalization and death. The FDA is considering this possibility and by June 2022 a decision about the vaccine composition is needed, in order to be ready for a potential October for the 2022-2023 season.

Full Story: Regulatory Focus

MEDICARE

Impact of Lowering Medicare Age

Lowering the Medicare eligibility age to 60 years would boost the number of enrollees by 7.3 million and increase the U.S. budget deficit by $155 billion over five years. This according to an analysis by the Congressional Budget Office and Joint Committee on Taxation. Projections show that about 3.2 million fewer people would have employer-sponsored insurance, with many of them switching to Medicare.

Full Story: Axios

Medicare Part B Premiums Stable for 2022

Medicare Part B premiums will not be readjusted this year by HHS. This may disappoint beneficiaries hoping for relief from the 14.5% increase. However, Part B premiums are likely to fall in 2023 as a result of cost savings on Aduhelm, a drug to treat Alzheimer’s.

Medicare Part B premiums rose from $148.50 per month in 2021 to $170.10 per month this year, driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and the uncertain pricing and utilization of Aduhelm, a new drug to treat Alzheimer’s disease.

“Given the information available today, it is expected that the 2023 premium will be lower than 2022,” an announcement from CMS said. The final premium determination will be made this fall. In their report CMS determined that it was impractical to try to adjust Medicare Part B premiums mid-year in 2022.

Read the report here and an article here.

DISABILITY AND RETIREMENT

Disability Coverage Essential for Retirement Planning

Three authors weigh in

Why do clients need disability insurance when planning retirement? Faisa Stafford in an article for ThinkAdvisor states it plainly: “To have an income after retirement, an advisor’s typical client will need to have an income before retirement.”

ThinkAdvisor author Wade Seward concurs in a separate article, saying “If they lose their income, how will their retirement plans, or other plans, happen?”

Lacey Brooke of LIMRA reiterates that disability insurance and a secure retirement go hand-in-hand in her article on the topic stating, “beyond income protection, disability insurance can help safeguard retirement goals by preventing early withdrawals. Pulling from retirement plans early can be more costly in the long run due to the loss of retirement funds coupled with tax penalties. LIMRA research shows the majority of consumers have no insurance against a disability and would need to tap into other sources of financial assistance, which threatens their long-term financial goals.”

ACCESSING CARE

Americans Avoiding Costly Care

HeathSparq’s 2022 Annual Consumer Sentiment Benchmark found 44% of Americans have skipped health care because they were uncertain of the cost, up steeply from 25% a year ago.

Two-thirds of respondents who said their health plan provided cost transparency tools said they had used them within the past year, and most of those said the tools help with understanding their health coverage, making informed decisions and managing expenses.” Full Story: Healthcare Finance

LONG-TERM CARE

Long-Term Care Planning is Shifting

Planning for long-term care is changing. Here’s how, according to Alison Bell of ThinkAdvisor. Caregiver support organizations are going one way. Insurers are taking another path.

The reality is, advisors know that the risk of needing long-term care is coming at their clients, their own parents and other loved ones now, with no respect for insurers’ or investors’ fear.

HEALTH EQUITY

Improving Health Equity Requires Boots on the Ground

Lowering barriers to care is the dictum of Priority Health President Praveen Thadani and Wellframe Chief Medical Officer Sandhya Gardner. They discuss how their teams are bridging the health equity gap to better meet members where they are. Listen now.

FINANCE

Exploring 10 Investor Types

Are you a Contrarian or a Catalyst? Knowing your investment personality type, and the types of your clients can help you meet their unique needs, says performance coach and clinical psychologist Alden Cass. But how to best determine — and why? Interviewer Jane Wollman Rusoff queries Cass.

“You need to cater to what the client wants to hear in order to feel like you’re accommodating their needs and helping them get excited about the investment process,” says Cass.

Smart financial advisors know that one-size does NOT fit all. Cass gives you some pointers here.

EVENTS

- Insurance Industry Charitable Foundation (IICF) Inclusion in Insurance Forum Advancing Ideas into Action. In person: New York, June 9 • Los Angeles, June 16 Chicago, June 20 • Dallas, June 22. Registration info here.

- National Association for Fixed Annuities (NAFA) 2022 Annuity Leadership Forum, in person, June 13-14, Washington, DC. Info here.

- OnRamp Insurance Conference: the leading conference for insurance innovation, June 15, Minneapolis-St. Paul, MN. Info here.

- National African-American Insurance Association (NAAIA) Juneteenth Event, June 16. Info here.

- NAHU 2022 Annual Convention: The Power of Story, in person: June 25-28, Austin, Texas. Info here.

- Isolved Webinar: Debunking the Top ACA Myths, June 21, 2022 11:00 am PST/2:00 pm EST. Registration is Open!

- CAHIP Engage, Statewide Leadership Conference, July 18 & 19, 2022, Universal City, Calif. Register here.

- IEAHU, OCAHU & SDAHU Senior Summit, Aug 23-25, in person, Pechanga resort, Temecula, Calif. Register here.