Kaiser Health News reports that the cost of insuring teenagers will spike in 2018. The price surge stems from a change in federal regulations that allows insurers to recalculate the health risks of children within a family’s premium bill. Despite the policy change for kids, they will still be considerably cheaper to cover than their parents. Read the whole story here.

Kaiser Health News reports that the cost of insuring teenagers will spike in 2018. The price surge stems from a change in federal regulations that allows insurers to recalculate the health risks of children within a family’s premium bill. Despite the policy change for kids, they will still be considerably cheaper to cover than their parents. Read the whole story here.

Sutter Health Plus Plans Expand to Santa Cruz County

Not-for-profit HMO Sutter Health Plus announced plans to offer health care coverage to employers and consumers in Santa Cruz County. The health plan will begin its sales and marketing efforts now with coverage effective as early as Jan. 1, 2018, pending regulatory approval. Once approved, the Sutter Health Plus network in Santa Cruz County will include Palo Alto Medical Foundation and its care centers throughout the county, Sutter Maternity & Surgery Center and Watsonville Community Hospital. Members will also have access to El Camino Hospital in Los Gatos, a Sutter Health Plus participating provider since 2015. The move into Santa Cruz County will mark the third geographic expansion since the health plan’s launch in 2014. Today, Sutter Health Plus has grown to serve nearly 70,000 members.

Commonwealth Fund Post Says ACA Dealt a One-Two Punch

The Trump administration dealt a one-two punch to the Affordable Care Act’s health insurance marketplaces and the Americans who buy their health plans through them, according to The Commonwealth Fund’s Sara Collins. In a new To the Point post, she explains that the first blow was an executive order to federal agencies to write new regulations allowing the sale of insurance that doesn’t meet the ACA’s consumer protection standards. The second was the administration’s decision to end payments to insurers for the ACA’s cost-sharing reductions (CSRs). The second punch has the power to be a knockout, Collins says, one that could trigger premium spikes and ultimately a mass exit of insurers from the marketplaces by 2019. Read Collins’ entire post for more.

Best Report: Medicare Advantage Sector Balloons, Margins Remain Squeezed

A new A.M. Best special report says that net premiums written in the highly competitive Medicare Advantage sector nearly tripled to $187.5 billion in 2016 from $69.9 billion in 2007. Double digit growth rates have been the norm for the past decades, reaching as high as 22 percent in 2011 and 20 percent in 2014. The MA market is fairly concentrated, as the top players — UnitedHealth, Humana and the Kaiser Foundation– account for 50 percent of MA enrollment, and the top 10 players account for over two-third of the segment’s enrollment. Access the full report here.

Moody’s Upgrades CNA

Moody’s Investor Services announced that it had upgraded the CNA Financial Corporation insurance financial strength rating to A2 from A3, with a stable outlook. In addition to the upgrade of CNA’s insurance financial strength rating, Moody’s affirmed the debt ratings of CNA Financial Corporation. For more information, visit CNA at a Glance.

Insurance CEOs Make Harvard Business Review List

Congrats go out to a few insurance industry execs. Aflac’s chief executive officer Daniel P. Amos was named to the Harvard Business Review’s 2017 list of the 100 Best-Performing CEOs in the World. Amos makes the list this year at #33. Joining him are Aetna’s Mark Bertolini (#75) and UnitedHealth’s Stephen Hemsley (#78).

MassMutual Study: African Americans Welcome Financial Guidance & Education

According to a new study by Massachusetts Mutual Life Insurance Co., African Americans are more likely to face greater financial difficulties than other middle-income Americans, including saving for retirement, and would welcome more financial education and guidance through their employers. While 63 percent of middle-income Americans overall say they feel “very” or at least “somewhat” financially secure, only 51 percent of African Americans say the same, according to the MassMutual African American Middle America Finances Study. The study, which surveyed 492 African Americans with annual household incomes of between $35,000 and $150,000, found that even higher earners expressed financial misgivings: 45 percent of African Americans with annual household incomes of $75,000 or more say they feel less than financially secure compared to just 28 percent of other Americans in the same income category.

Worth a Read: Colonial Life Research Shows Value of Enrollment Tech

Most U.S. businesses still use old school pen and paper to enroll employees in benefits and conduct HR tasks and requirements, but a strong benefits provider who can bring along a trusted technology vendor can help employers save time and money, according to a new white paper released today by Colonial Life.

“High-Tech Benefits: A strong carrier can be an invaluable partner during enrollment season – and the rest of the year” uses industry and internal company research to illustrate solutions available to help employers not only survive enrollment season but also to streamline HR responsibilities the rest of the year.

The white paper explains the market opportunities available to insurance agents and brokers, the improved enrollment experience technology can provide to workers and the benefits a one-stop shop can give to businesses throughout the year.

NAILBA 36 – Nov. 16-18, Hollywood, Florida

National Association of Independent Life Brokerage Agencies (NAILBA) 36th Annual Meeting will take place at the Diplomat Beach Resort. The meeting will attract high level representatives from brokerage general agencies, life insurance carriers and insurance industry vendors. More info at the NAILBA36 page.

LAAHU Holiday Party- Dec 19, Tarzana (change of venue)

LAAHU, with support from Health Net, will host a holiday cocktail party at Chablis food +wine in Tarzana Dec 12 from 4:30pm-7:30pm. Cost of admission is an unwrapped toy or $15. Note the new location! Register here.

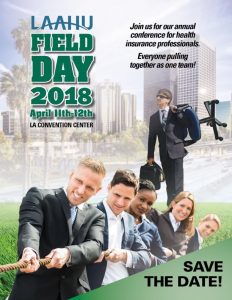

Also: Save the date!

Also: Save the date!

LAAHU Annual Conference at

LA Convention Center will be

April 11th & 12th, 2018

Sponsorship & Exhibitor

Information coming soon