The Washington Examiner reported that shareholders voted Tuesday to allow drugstore chain CVS Health to buy health insurer Aetna, in a deal that both parties say will transform the way healthcare is delivered. The agreement, estimated at $69 billion in cash and stock, would combine health coverage options with drugstore capabilities and a pharmacy benefits platform. Even after clearing this shareholder hurtle, the CVS-Aetna merger must be approved by the Justice Department and the Federal Trade Commission. “When this merger is complete, the combined company will be well-positioned to reshape the consumer health care experience, putting people at the center of healthcare delivery to ensure they have access to high-quality, more affordable care where they are, when they need it,” Larry Merlo, CVS Health president and CEO, said after the vote.

The Washington Examiner reported that shareholders voted Tuesday to allow drugstore chain CVS Health to buy health insurer Aetna, in a deal that both parties say will transform the way healthcare is delivered. The agreement, estimated at $69 billion in cash and stock, would combine health coverage options with drugstore capabilities and a pharmacy benefits platform. Even after clearing this shareholder hurtle, the CVS-Aetna merger must be approved by the Justice Department and the Federal Trade Commission. “When this merger is complete, the combined company will be well-positioned to reshape the consumer health care experience, putting people at the center of healthcare delivery to ensure they have access to high-quality, more affordable care where they are, when they need it,” Larry Merlo, CVS Health president and CEO, said after the vote.

Most U.S. Adults Believe Affordable Healthcare a Right

The nonprofit Commonwealth Fund’s Commonwealth Fund Affordable Care Act Tracking Survey says most U.S. adults, regardless of political affiliation, now believe all Americans should have the right to affordable health care. That said, 36 percent of Americans who have health coverage through the ACA’s marketplaces and 27 percent with Medicaid are pessimistic about keeping their coverage in the future; half point to recent federal actions.

Benefits and Insurance Groups Urge Congress to Stabilize Health Insurance

Employee Benefit News reports that a coalition of insurance and employee benefits groups — including the American Benefits Council, America’s Health Insurance Plans, American Academy of Family Physicians, American Hospital Association, American Medical Association, Blue Cross Blue Shield Association, Federation of American Hospitals and the U.S. Chamber of Commerce– is urging Congressional leaders to act quickly on bipartisan legislation to stabilize the health insurance market. The groups say immediate action is necessary to reduce premiums. The groups have called on Congress to pass proposals that would establish a premium reduction, or reinsurance, program to help insurance companies cover the costs of high-risk patients and to provide funding for cost-sharing reduction benefits that were cut by President Donald Trump last year.

Recent Tax Reform Revises Downward HSA Family Contribution Limit

Heads up! The recent tax reform law includes a slight change for health savings accounts (HSAs). Page 400 of IRS Bulletin number 2018-10 contains a revision -downward – of the HSA family contribution limit. According to this post by PayPro Administrators, the revision is due to a change in how the amount is calculated. “Chained CPI” will be used for annual inflation adjustments beginning with the 2018 tax year instead of using the CPI (Consumer Price Index). For the tax year 2018 the new “chained CPI” calculation will reduce the HSA contribution limit for family coverage to $6,850 instead of $6,900. This is a reduction of $50. The self-only limit remains unchanged from the previously announced amount of $3,450.

Guardian Workplace Benefits Study

The Guardian recently released it’s 5th Annual Workplace Benefits Study. Here’s a link to the dental coverage benefits part of the study. Look for an interview about the study findings with Randi Tillman, DMD, Guardian’s assistant vp and chief dental officer, soon!

Paralympic Spirit and The Standard’s Tom Foran

A few weeks ago we mentioned how inspired we were by the Olympic athletes. Steve Siebold, a former professional athlete and psychological performance coach to entrepreneurs and Fortune 500 executives, says business people can learn tons of valuable lessons from elite athletes. Guess what? There’s something even more inspiring this week: The 2018 Paralympic Games, which will be wrapping up on March 18. It’s a must-watch for anyone who wants to be humbled by greatness. Speaking of greatness, California Broker is honored to have The Standard’s Tom Foran contributing to our upcoming April issue. Tom is the vice president of underwriting and product development at The Standard and has worked in the insurance industry for more than 30 years. He’s also a five-time Paralympic medalist and former world-record holder in wheelchair racing!

Our March issue is up!

Cal Broker’s March print issue is now available online. Did you catch John Sarich‘s guest editorial on tax reform and insurance? Don’t miss HIXME CEO Denny Weinberg explaining how his company aims to be a large group disruptor or Louis Brownstone‘s excellent update on The California Partnership for LTC. And that’s just a taste of the great industry coverage.

Alliance Promotes Buffo, Goldfine, Disco

Alliance Group, a national life insurance marketing organization, recently announced a wave of title changes and promotions for several key employees. Andrea Buffo was announced as the new business development manager, serving as the key liaison between agents, agencies and the Alliance Group home office, as well as their insurance carrier partners. Peter Goldfine assumed a new role as director of digital innovation, and Chrissy Disco was promoted to creative director.

EVENTS

Ventura County Association of Health Underwriters Chili Cook Off

March 15, 12-4p.m., Camarillo Ranch House

$25 for members / $35 for guests

Games, chili, dessert & a C.E course included. More info here.

IICF Horizon Award Gala

March 15, The Globe Theatre, Los Angeles

Register here.

NAC3, the North American Crypto Currency Conference

March 24-25, Playa Studios, Los Angeles

Event appropriate for seasoned crypto currency pros and those merely curious about Bitcoin, Ethereum, Blockchain etc. Tickets and info now available at https://www.nac3.io. Companies interested in sponsorship can contact info@nac3.io for details.

LIMRA Life Insurance Conference

April 9-11, Marriott Downtown Magnificent Mile, Chicago, IL

Using predictive modeling, data scientists at LIMRA’s new Center of Excellence for Data Analytics have identified factors that influence individual life insurance buying behavior and have built profiles of types of customers who are likely to buy. This analysis, along with experts of social economics and customer experience, will be featured at the conference, which is jointly hosted by LIMRA, LOMA, the Society of Actuaries (SOA) and the American Council of Life Insurers (ACLI). Register here.

LAAHU Annual Conference- Field Day 2018

April 11-12

Los Angeles Convention Center

Janet Trautwein, NAHU CEO,

will be among the guest speakers.

Trautwein will give a 2018 Federal Update –

find out what is going on in Washington, D.C.

Registration, exhibit and

sponsorship info now available!

Big “I” Legislative Conference

April 18-20

Grand Hyatt Washiington

Washington, D.C.

Attend a one-of-a-kind legislative event for the independent agency system and educate members of Congress on issues important to you and your clients. Registration includes an in-depth issues briefing, legislative breakfast with high-profile Congressional speakersHouse Democratic Whip Steny Hoyer (D-Maryland) and Senate Majority Leader Mitch McConnell (R-Kentucky), a general session and networking opportunities. Register here.

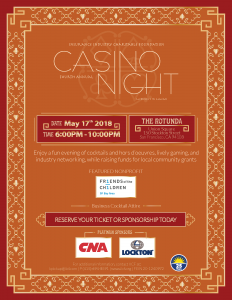

IICF Casino Night

May 17, The Rotunda, San Francisco

Join the Insurance Industry Charitable Foundation for a fun night of gambling and insurance industry networking while also raising money for community grants. The event takes place at The Rotunda, Union Square, San Francisco. Registration and sponsorship info available here.

NAILBA 37

November 1-3, Gaylord Palms Resort and Convention Center, Orlando, Florida

Detailed information about NAILBA 37 will be available soon. Exhibit hall and sponsorship opportunities available here. Or contact etoups@nailba.org for more info.