Last year the Los Angeles Association for Health Underwriters collected $3,678 and paid for the transportation of 141 kids to Camp Ronald McDonald for Good Times. Good news: they’re going to do it again! If you would like to support LAAHU’s December 2019 event, please contact member-at-large Donald Weiss at (310) 451-6277 or e-mail don@donaldweiss.com. Want to know more about the cause? Don Weiss has contributed the following post:

As a LAAHU board member, I’ve been delighted to chair our annual member appreciation/ fundraising event during the December holiday season. For the past several years the recipient of our fundraising efforts has been Camp Ronald McDonald for Good Times. Thanks to generous member contributions, last December we funded the cost of buses to transport kids from the Ronald McDonald House in Los Angeles to the camp which is nestled in bucolic Idyllwild, CA. The camp is for children who have been diagnosed with cancer, as well as for their healthy siblings, whose needs many times get obscured by the child battling this disease. This past July I visited the camp with my wife, and we were beyond impressed.

The intent of the recreational, fun experience is to normalize the campers’ childhoods. This is a realistic goal as, fortunately, with proper treatment 85% of pediatric cancers are cured. The entire tone and attitude at camp is positive, uplifting, supportive, and fun, and the mission is to provide a healing and memorable experience for each camper. Parents have shared that their children return home with greater self-reliance, improved social skills, renewed hope, and an overall more positive outlook on life and themselves. This is found through their outdoor experiences riding horses, fishing, hiking, relay racing, archery, swimming, and more, and bonding through others who are also battling this illness.

While this camp experience is 100% funded by private donations, what I found equally impressive about the camp was the staff. They are all volunteers, who exude enthusiasm and compassion for the campers and other staff members. In particular, I must highlight Dr. Judith Sato, a pediatric oncologist from the City of Hope Hospital in Los Angeles, who has volunteered at the camp every summer since 1983. She also serves on the Camp’s Board of Directors, and has traveled internationally with campers and staff to model similar camps overseas.

On behalf of our LAAHU membership “The LAAHU – LIGANS” we are proud and gratified to support such a great and noble cause. — Donald Weiss

Thanks to Don and all LAAHU contributors!! #Agentsmakingadifference

IICF Raises $35,000 for San Francisco Nonprofits at Diversity & Inclusion Conference

The Western Division of the Insurance Industry Charitable Foundation (IICF) hosted a Women in Insurance Conference Series Aug. 15 at the Nasdaq Entrepreneurial Center in San Francisco that raised nearly $35,000 for local nonprofits.The sold-out conference featured several notable guest speakers who continued the industry conversation on the business case for advancing diversity and inclusivity in the workplace. Speakers included Gloria Watson, Head of Specialty, North America General Insurance AIG, Cheryl Lloyd, Chief Risk Officer at the University of California and Alex Littlejohn, US West CRB Region Leader, San Francisco market leader at Willis Towers Watson, among others. The IICF Western Division has awarded more than $475,000 in nonprofit grants to date in 2019.The San Francisco conference was a part of IICF’s Women in Insurance Conference Series. IICF has just announced the dates for its 2020 Regional Women in Insurance Forums. The Western Division will host its 2020 Women in Insurance Regional Forum on June 24 at the Omni Los Angeles Hotel in Los Angeles. Additional 2020 Regional Forums will be held in Chicago and New York City on June 3 and in Dallas on June 17. For details please contact Melissa-Ann Duncan at maduncan@iicf.com.

A Fine Day at the Medicare Summit

The LAAHU/VCAHU Medicare Summit at Pickwick Gardens in Burbank is going great! Agent Janis Shibata actually made a whole basket of goodies, which Nat Gen’s Kellie Bernell and Cal Broker’s Thora Madden sincerely appreciated! Yesterday we dropped into the Humana product rollout and was heartened to hear the company is offering several new products specifically for vets! Peter Bauer, Region 9 CMS Rep, also gave a great talk where agents clarified some issues about C.O.B.R.A. and individual plans being considered creditable coverage for Part B and Medigap. You can get a copy of Peter’s presentation and other resources at the CMS National Training Program. Today’s speakers included Barry Sikov and Elizabeth Mack, both who will be contributing articles to upcoming issues of California Broker. Speaking of which…keep your eyes peeled for monthly Medicare Insider articles in the pages of our print magazine. We know there’s a lot going on!

Taking a Closer Look at MA Spending

A new Health Affairs report concludes that while Medicare Advantage spends between 2.2% and 5% more than traditional Medicare, it’s not producing the savings it was supposed to. Researchers say we need to rethink what we’re doing if we want to save U.S. taxpayers and treat seniors right.

Exploring the Mama Workforce Drain

According to a recent EBN post, a full 50% of women never return to full-time employment after giving birth to their first child.

For many parents, they do the simple math of how much they spend after taxes on childcare versus income, and if there isn’t a meaningful difference, they simply drop out of the workforce.

Employers want to ameliorate the female workforce drain. Yet they don’t seem to understand how affordable, quality childcare might be a doable benefit. EBN writer Charles Bonello explores some keys myths around childcare that employers might want to consider. Read more here.

MassMutual Boosts TPA Support

As part of its focus on growing its retirement plans business, MassMutual announced it is enhancing field support and providing new digital tools for third party administrators (TPAs) that support 401(k)s and other defined contribution retirement plans. The enhancements include the addition of three TPA field support staff and launching a new website to provide tools and information for TPAs that work with MassMutual. The website provides TPAs with information about MassMutual’s TPASmart program and how it supports their efforts, materials for TPAs to promote their capabilities, a fiduciary calendar for administering retirement plan regulatory requirements and information about MassMutual’s TPA incentive program. TPAs provide support for 66% of MassMutual’s retirement plans.

In addition, MassMutual has increased its TPA field support unit with three new appointments:

- Kathy Lake is TPA Market Director for the Southern Division. Previously, Lake was a Client Engagement Manager for MassMutual retirement plans. She has more than 20 years of experience in retirement education, sales and service center operations and has held management positions at Jackson National Life and The Hartford.

- Lynette Golly is TPA Market Director for the Central Division. She joined MassMutual in 2015 after owning her own TPA firm for nearly 25 years. Most recently, Golly served as Client Engagement Manager for MassMutual, supporting retirement plans and voluntary benefits.

- Rob Ayers is TPA Champion, responsible for deepening and enhancing MassMutual’s relationships with payroll providers. Ayers most recently was Managing Director of Benefits in MassMutual’s Worksite Solutions. His experience also includes TPA Market Development and Managing Director in MassMutual’s Emerging Markets and more than 10 years in various sales roles, including with Merrill Lynch.

The new additions join Kellen Craig, who is based in Arizona and covers our Western Division.

U.S. Could’ve Saved $17.7 Billion with Simple Med Switch

This is sort of, well, hard to swallow… a study published this week in the Annals of Internal Medicine laid bare what seems to be a egregious money grab from U.S. drug manufacturers. Researchers say manufacturers have frequently brought slightly different versions of their meds (called single-enantiomer drugs) to market shortly before the original versions (called racemic precursors) are eligible for generic competition. Bringing the new drugs to market establishes new, patent-protected drugs that put more dinero in the bank for manufacturers. Here’s the kicker: the newer versions aren’t improved versions. In fact, in most cases they are exactly as effective as the older drugs. But how much money does manufacturers rake in with this move? Researchers say Medicare Part D spending from 2011 to 2017 would’ve been almost $18 billion less if doctors would’ve continued to prescribe the racemic precursor versions of drug instead of the single-enantiomer versions.

NAHU Region VIII Leadership Conference

August 25-26, The Queen Mary, Long Beach

Training and strategic planning for all local board positions, plus an opportunity to network with other leaders. Early bird pricing of $149 includes evening reception on 8/25 and a full day of conference on 8/26. Stay in a deluxe stateroom for only $129. Patrick Burns, NAHU Region VIII vp, will preside as ship captain. The event is hosted by LAAHU and OCAHU.

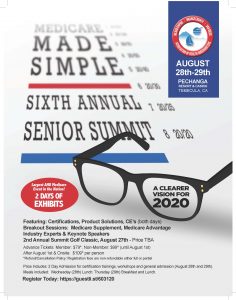

Association of Health Underwriters Senior Summit– We’ll see you here!

August 28-29, Pechanga Resort & Casino, Temecula

The Sixth Annual Senior Summit sponsored by the Inland Empire, Orange County and San Diego Associations of Health Underwriters is the largest AHU Medicare event in the country. Keynotes, breakout sessions, CE and much more. Early bird pricing in effect until Aug 1: $79 for members, $99 for nonmembers. Register here.

LISI Health Benefits & Tech Summit

August 29- Santa Clara

Sept 9- Irvine

LISI presents BETA, the first health benefits and technology summit dedicated to improving the benefits industry through technology-focused collaboration and forward thinking. Network with a community of professionals engaged in the development of broker, carrier and partner technologies. Educational talks, tech focus groups, CE credit courses, guest appearances and much more. Admission is free! Registration and info here.

NAIFA- Los Angeles- Life Insurance Awareness Event

August 29, 2019, 11:30 am – 1:30 pm, Taix French Restaurant, Echo Park

PERKS LA – The Employee Experience Expo- We’ll see you here! Discount for CB readers!

September 11, Magic Box @ The Reef, Los Angeles

See the largest selection of perks, services, amenities and benefits for your clients, prospects and their employees. Plus VIP workshops and fitness, giveaways, free food and drink samples, happy hour and more for all ticket holders. Register at here with code CALBROKER (20% off!) and also check out sponsor/exhibiting details.

NAAIA National Conference & Empowerment Summit

Sept 11-13, Atlanta Marriott Marquis, Atlanta, GA

Leaders from across the insurance and financial services profession will come together at this high energy industry event to further the education, advancement and uplifting of African American insurance professionals. More info at www.naaia.org.

LIMRA Group & Worksite Benefits Conference

Sept 10-12, Newport Marriott, Rhode Island

The conference will focus on key industry issues, including factors driving change in the benefits market. Executives and professionals in the workplace benefits area are encouraged to attend and network at this collaborative event. Tom Wamberg, chief executive officer, Wamberg Genomic Advisors, will open the conference by talking about how genomic developments will change every long-held belief of the life and health insurance industries. He’ll discuss genomic products and their potential risks, rewards and regulations. The following day, these industry leaders will share their thoughts on today’s most important topics in the workplace space:

- Lori L. High, senior vice president, Sales & Relationship Management – Group Benefits, The Hartford Financial Services Group, Inc.

- Gene Lanzoni, assistant vice president, Thought Leadership – Group & Worksite Marketing, Guardian Life Insurance Company of America;

- Jeanette Rice, president and chief operating officer, American Fidelity Assurance Company; and

- Bill Smith, president, Cigna Group Insurance

Registration and info here.

LAAHU seminar- The Art of Networking

September 19, Skirball Cultural Center, 9 a.m.

Speaker Sarah Shirazi-Reznick will cover the how to be more effective and intentional in networking environments. Topics will cover include niche marketing, how to choose your network groups, power partners, elevator speeches and much more. Register here.

CAHU Annual Conference & Symposium

Oct 3-5, Costa Mesa

Register here for early bird rates.

Alliance of Comprehensive Planners 2019 Annual Conference

Nov. 12-15, Hyatt Regency Mission Bay, San Diego

The Alliance of Comprehensive Planners (ACP) is a community of tax-focused financial planners who provide planning strategies for clients on a fee-only retainer basis. Conference early bird registration rates (which expire Oct. 11, 2019) are in effect now. Participation is open to all interested financial professionals. Companies interested in sponsoring the ACP Annual Conference should contact Jill Colsch at jill@acplanners.org. The agenda is available here: https://2019.acplanners.org/home. More info here.

CAHU Women’s Leadership Conference

March 25-27, 2020, JW Marriott Resort&Spa, Las Vegas

Save the date! Get early bird pricing by registering by 8/31/19 and using code NAHU19. More info at www.cahu.org.