Janet Trautwein, Chief Executive Officer of the National Association of Health Underwriters (NAHU) and President of the National Association of Health Underwriters Education Foundation in Washington, D.C., will host a post-election webinar November 15, 8:45-10a.m. Learn about the significance of the 2018 midterm Congressional elections and how they may shape the 116th Congress set to begin in January.

Janet Trautwein, Chief Executive Officer of the National Association of Health Underwriters (NAHU) and President of the National Association of Health Underwriters Education Foundation in Washington, D.C., will host a post-election webinar November 15, 8:45-10a.m. Learn about the significance of the 2018 midterm Congressional elections and how they may shape the 116th Congress set to begin in January.

The session will examine: legislative and regulatory actions affecting health policy and how NAHU develops and achieves advocacy goals; the increased interest at the federal and state levels in single-payer or similar legislation; NAHU’s policy priorities for the 116th Congress; major regulatory actions that have been taken and are expected in the near-term and later and the role that NAHU is having in this process; and how NAHU members, the overall agent/broker community, and employers can get involved. Register here.

Share This Advice About Open Enrollment

There’s good advice up on USAToday about how clients can save money by making wise choices during open enrollment. Share the info with your clients!

Health Net Awards Grants to Local Physician Groups

Health Net of California announced it has awarded $5.85 million in research grants to local physician groups to assess how quickly, completely and accurately patient encounter data is collected. Findings from the grant-funded research could identify best practices that ultimately help Medi-Cal enrollees receive more effective preventive care services, and remain healthier longer.

Encounter data, the administrative information that describes health care interactions between patients and providers, must be collected by state law in California, and can help the state and insurers direct preventive care programs, like cancer screenings, to those that need them the most.

Health Net’s initiative is intended to help strengthen the data collection and reporting infrastructure of the Medi-Cal delivery system.

In all, the company awarded 19 grants to Medi-Cal managed care providers. Grant recipients include:

- Accountable Care IPA in Los Angeles County

- Altura Centers for Health in Tulare County

- BAART Community Healthcare in Contra Costa, Fresno, Los Angeles, and San Francisco counties

- Community Medical Centers in San Joaquin, Solano and Yolo counties

- Family Healthcare Network in Kings and Tulare counties

- Global Care in Los Angeles County

- HealthRIGHT 360 in San Francisco County

- Health Care LA in Los Angeles County

- Hill Physicians in Sacramento and San Joaquin counties

- Kern Pediatrics in Kern County

- KHEIR Community Clinic in Los Angeles County

- La Maestra in San Diego County

- Omni Health Centers in Fresno, Kern, and Kings counties

- Preferred IPA of California in Los Angeles County

- Riverwalk Pediatric Clinic in Kern County

- San Benito Medical Associates in San Benito County

- Seaside Health Plan in Los Angeles County

- Serra Community Medical Clinic in Los Angeles County

- Walton Pediatric in Sacramento County

CMS Proposes Funding for More MA Telehealth

The Centers for Medicare & Medicaid Services (CMS) released a proposed rule last week that essentially allow many more Medicare Advantage patients to partake in government-funded telehealth benefits starting in 2020. Under the proposed rule, MA plans would be able to offer telehealth services to all plan members, regardless of where they live, and would have greater flexibility in how they pay for telehealth benefits. It also allows MAmembers to receive telehealth at home. The traditional fee-for-service Medicare program has restricted telehealth services to certain sites in rural areas.

Millennials (and others) Want to See Clearly

Vision insurance has historically most appealed to older workers with aging eyes, but things seem to be changing. Recent research by employee benefits provider Unum found that the elimination of vision benefits might motivate more than a third (34 percent) of U.S. workers ages 25 to 34 to look for a new job. These results and other findings were part of an online poll of 1,227 working U.S. adults conducted by Unum in July. Other age ranges also reported they would consider leaving their current employer if their vision benefits were eliminated:

- 29 percent of those 18 to 24

- 24 percent of those 35 to 49

- 21 percent of those 50 to 64

- 18 percent of those 65 and older

Voya Exits Individual Market

Voya Financial announced on Tuesday evening that by the end of the year it will no longer sell individual life insurance business. Instead, the company plans to focus on higher-growth business lines. Voya decided to exit the individual life business following a strategic review, according to CEO Rodney O. Martin Jr. Moving forward, the firm will focus on its retirement, investment management and employee benefits units, which Martin said are “higher-growth, higher-return, capita-light businesses.”

LIMRA’s Kerzner Passes Torch to Levenson

(David Levenson, incoming CEO of LIMRA)

LIMRA’s long-time CEO Robert Kerzner is calling it a day. The LIMRA board has picked David Levenson, a principal at Edward Jones and former Hartford Financial Services Group Inc. executive, to replace Kerzner as CEO. At its annual NYC meeting recently, Levenson emphasized the importance of recognizing and embracing change. Under Levenson’s direction, LIMRA, a nonprofit, member-owned organization, will continue to embrace technology and evolutions in the life insurance market. Levenson told the NYC meeting attendees that if they don’t like change, they like irrelevance even more.

The Standard Promotes Gorsline

Standard Insurance Company announced that Erin Gorsline has been promoted to assistant vice president of Human Resources. In her new role, Gorsline will have responsibility for the Employee Benefits team as well as HR strategic, financial planning and workforce planning.

EVENTS

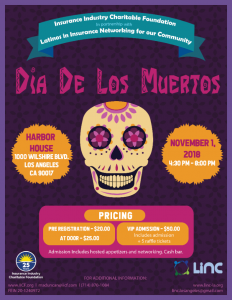

IICF/LiNC Dia de los Muertos Fundraiser

November 1- 4:30 pm – 8:00 pm

IICF and Latinos in Insurance Networking for our Community are proud to partner to present Dia de los Muertos. Enjoy hosted appetizers and an evening of industry networking for a good cause. Cash bar.

Pre Registration: $20.00, At Door: $25.00 VIP Admission: $50.00

– Includes admission and 5 raffle tickets. All proceeds benefit the IICF Community Grants Program and the LiNC scholarship program. Register here.

NAILBA 37

November 1-3, Gaylord Palms Resort and Convention Center, Orlando, Florida. Detailed information about NAILBA 37 will be available soon. Exhibit hall and sponsorship opportunities available here.

Or contact etoups@nailba.org for more info.

NAC3 Cryptocurrency Conference

December 8, Las Vegas

Come hang with Crypto Bobby, Ready Set Crypto, the Crypto Street Podcast crew and many more. This event’s focus will be on investment and how to take your gains to the next level in the current market. Register now for the early bird rate of $97. More info here.

LAAHU Holiday Party

Dec. 18, Traktir Restaurant, Tarzana, 4:30-7:30pm

Register here.

PIMA’s 2019 Industry Insights Conference

January 24-27, 2019, Margaritaville Beach Resort, Hollywood, Florida

Registration is now open for the Professional Insurance Marketing Association (PIMA) Industry Insights Conference. The conference will host expert speakers from leading companies around the country including Facebook, Forrester and Action Surge. Conference promises to explore new product and distribution trends; emerging markets that harness growth in new areas; social marketing to drive insurance business; marketing to Millennials and Gen Z; and an insurance industry overview of blockchain. Early bird registration and housing deadline is December 14, 2018. Visit PIMA’s conference page for more details and to register or call 817-569-7462 (PIMA).