Seems like the issue with the baker who refused to produce a cake for a wedding between two men has now made its way to the health care arena. The Trump Admin issued a federal rule this week called “Protecting Statutory Conscience Rights in Health Care.” The rule essentially allows health care providers to refuse care to patients based on personal beliefs. In response, California Insurance Commissioner Ricardo Lara issued a written statement saying:

“The Trump Administration has issued a damaging rule that permits health care providers to deny patients needed treatment, even life-saving treatment in emergencies, on the basis of the provider’s ‘religious or conscience’ objection. This rule invites discrimination and particularly threatens the health of women, members of the LGBTQ community, and persons living in communities with few medical treatment options. The rule even appears to permit medical providers to refuse to refer patients to other medical providers who could provide the necessary care. We need to ensure that Californians can obtain the care they need, rather than being turned away in the name of intolerance by someone in the healing profession. I will strongly support legal efforts to block this rule from going into effect.”

Human rights organizations have also denounced the federal rule, saying that health providers can now put personal beliefs over delivery of care, including lifesaving measures.

Pasadena Agent Charged with Felony Identity Theft; CDI Asking for Help

Pasadena licensed health agent Helen Lee has been charged with nine felony counts of identity theft after allegedly using personal health information to forge fraudulent agent of records forms. Lee, co-owner of health concierge services companies Joany Inc. and California Health Benefit Exchange, filed more than 65 agent of record change forms between January and March 2017. The California Department of Insurance contends that Lee created an online Craigslist survey, marketed as an online health insurance research study, to obtain personal identifying information. Lee paid participants $50 if they met certain criteria and texted a photo of their member ID card which included effective dates of coverage. The survey had a HIPPA-compliant logo and participants were told it was only to help consumers with their health insurance needs and that the information would not be sold or provided to any third party. However, participants’ information was used to change their agent of record and their signatures were forged on the documents. The survey specifically targeted people who purchased insurance through Covered California and didn’t receive health care through their employer and were not part of Medicaid, Medicare or VA health insurance. However, the agent’s illegal activities may have stretched beyond the state and CDI is assisting those investigations. If anyone has potentially helpful information, call CDI at 323-278-5000.

CVS Project Health Makes Splash in Sacramento

CVS Health announced an expansion of its annual Project Health free health screening campaign with a community event at CVS Pharmacy in Sacramento. There will be 32 free health screenings that will take place in the Sacramento area between now and June 30.

The event also included the presentation of a $75,000 grant from the CVS Health Foundation to the Sacramento Native American Health Center to help expand opioid treatment options locally. The funds will be used to help engage more patients with internal treatment options like medication-assisted treatment, cognitive behavioral therapy (CBT), trauma-focused CBT and integrative or holistic therapies.

Trump Admin Targets Secrecy Pricing in Healthcare

The Wall Street Journal reports that the Trump Administration is making its first overture toward price transparency in healthcare by soliciting comments on a proposal to require doctors and hospitals to publish negotiated prices. If you’d like to see just a sample of what we may learn, read this New York Times article by Margot Sanger-Katz on the cost discrepancy of a simple blood panel. Of course, costs all depend on the negotiations between health care provider and insurer. In San Francisco that blood panel might be $80 or $564. In Los Angeles, it might cost $12 or $413. Read more from the nonprofit Health Care Cost Institute, which crunched numbers on negotiated prices for some common health procedures in a handful of regions across the U.S. and found — no surprise to agents — massive cost discrepancies.

MassMutal Makes HSAs by Wex Available Through MapMyFinances

MassMutual announced it’s expanding its wealth accumulation and protection benefits at the workplace by making HSAs available on its MapMyFinances financial wellness tool for workers. The HSAs, powered by WEX Health, enable workers who are covered by high-deductible healthcare plans to put aside money on a tax-favored basis for eligible healthcare expenses during their working years as well as retirement. MapMyFinances was introduced by MassMutual earlier this year as part of its efforts to help all Americans achieve financial wellness. The MapMyFinances tool is available automatically at no cost through employers that sponsor MassMutual’s 401(k) or other defined contribution retirement plans, voluntary insurance benefits or both. The tool provides users with a personalized financial wellness score to help them assess their overall financial situation and makes recommendations to help workers prioritize their benefits choices based on their family situation and budget

UnitedHealthcare Adds SmileDirectClub Benefits

UnitedHealthcare Adds SmileDirectClub Benefits

UnitedHealthcare announced they are teaming up with SmiletDirectClub, a teledentistry and direct-to-consumer provider of clear teeth aligners. Now people enrolled in most UnitedHealthcare employer-sponsored and individual dental plans with orthodontic coverage can purchase SmileDirectClub’s clear aligners for less than $1,000 out of pocket. The companies say that more than 1.5 million UnitedHealthcare dental plan participants with orthodontic coverage can start the process by visiting SmileDirectClub.com to order an impression kit or schedule a 3D digital image at any of SmileDirectClub’s more than 235 SmileShops across the country. Through this collaboration, eligible UnitedHealthcare dental plan participants can review their benefit information and out-of-pocket expenses with SmileDirectClub customer care. Plan participants will soon be able to visit the SmileDirectClub website to enter their dental plan details to access real-time information and cost transparency.

Landmark Announces Rate Change, Encourages Migration to Expanded Plans

Effective June 1, 2019, Landmark Healthplan will price its Standard Plans the same as its Expanded Plans to encourage groups to migrate to the better benefits offered by the Expanded Plans. Standard Plan groups that renew starting August 1 will be encouraged to migrate to the same plan design in the Expanded Plan portfolio. Expanded Plan benefits are identical to those under the Standard Plan except that treatment never requires preauthorization and X-rays are subject to a $75 annual maximum benefit. By eliminating all managed care restrictions, Expanded Plans offer greater access to providers, allowing members to be treated not only for acute conditions but also for preventive, wellness and on-going maintenance care. Under Landmark’s Standard Plans, only “medically necessary” care of acute conditions is covered. Without this limitation, Expanded Plans generate substantially higher levels of member and provider satisfaction. According to Landmark:

Expanded Plans, due to their open access design, were historically priced almost three times higher than their Standard Plan counterparts. Effective immediately, Expanded Plans will be priced at just 15% higher than the equivalent Standard Plan for both new and renewing groups except that Bay Area Chiropractic Only plans will be 25% higher.

Groups already on an Expanded Plan will see a significant rate decrease of approximately 55% to 75% depending on the rating region, group size, and benefit plan. The above percentages are averages only and may be different on a case-specific basis. Groups with 200+ employees will continue to be experience rated.

Request an RFP at sales@LHP-CA.com.

Kaiser Foundation Says Maybe Insurers Get Too Much for MA Patients

A new Kaiser Family Foundation study finds that the government may be overcompensating insurers for Medicare Advantage patients. The study found that “beneficiaries who choose Medicare Advantage have lower Medicare spending – before they enroll in Medicare Advantage plans – than similar beneficiaries who remain in traditional Medicare, suggesting that basing payments to plans on the spending of those in traditional Medicare may systematically overestimate expected costs of Medicare Advantage enrollees.” Read the whole report here.

Life Insurers Issue First Q Earnings Reports

Gosh, ever wonder how life insurers are doing these days? Allison Bell over at ThinkAdvisor has a great post with all the first quarter earnings your heart desires. Simply put, the companies seem to be doing just fine.

Broden, Beaver and Kelso Get New Posts at Aflac

Aflac announced that Max K. Brodén has been named senior vice president; deputy chief financial officer and treasurer of Aflac Incorporated. In his new role, Brodén is responsible for enterprise corporate development, investor and rating agency relations, corporate finance, enterprise capital management and financial planning and analysis. Aflac also announced that Steven K. Beaver has been named senior vice president; chief financial officer, Aflac U.S. and J. Pete Kelso was named chief information and technology officer of Aflac Incorporated.

CAHU Capitol Summit & Expo

May 20-22, Sawyer Hotel, Sacramento

Join CAHU in Sacramento at the Sawyer Hotel for information about California and the future outlook for the industry. Hear from Commissioner Lara, representatives from the Governor’s office, legislators, political insiders and more about where California is headed.

Work alongside peers and other members as CAHU works to educate representatives on the critical role of the agent. Register here.

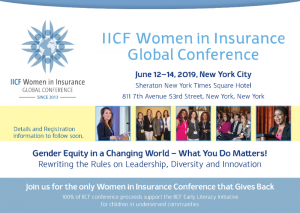

IICF Women in Insurance Global Conference

June 12-14, 2019, New York City

NAHU Annual Convention –We’ll see you here!

June 29-July 2, Sheraton San Diego Hotel & Marina

Keynote speaker is Retired Master Sergeant Cedric King. Sessions focus on practical solutions for your business, including retaining today’s new workforce, buying or selling your agency, data transparency and alternative healthcare management. And there’s an expanded Medicare Extreme! with proven practices and important trends on changes in Medicare, technology solutions, growing your business with group Medicare sales plus more. Plus plenty of opportunity to visit with a variety of vendors and network with colleagues More info here.

Alliance of Comprehensive Planners 2019 Annual Conference

Nov. 12-15, Hyatt Regency Mission Bay, San Diego

The Alliance of Comprehensive Planners (ACP) is a community of tax-focused financial planners who provide planning strategies for clients on a fee-only retainer basis. Conference early bird registration rates (which expire Oct. 11, 2019) are in effect now. Participation is open to all interested financial professionals. Companies interested in sponsoring the ACP Annual Conference should contact Jill Colsch at jill@acplanners.org. The agenda is available here: https://2019.acplanners.org/home.