Have you been out to see the California poppies? The California state flower is pretty spectacular right now. (But please don’t try to land your helicopter in the middle of them). On to insurance news…

Justice Dept Battles ACA; Dems Unveil New Plan

The Justice Department moved to strike down the Affordable Care Act in its entirety on Monday. This is what Representative Tom Reed, Republican of New York, told the New York Times:

“Not only is this a poor political move, this decision hurts real people who will unfairly lose their health insurance coverage as a result. We need to work to find ways to fix our health care system — not blow it up.”

In the past nine years, the Affordable Care Act has become deeply ingrained in the U.S. health care system. According to the same NYT article, the ACA:

“revamped the way Medicare pays doctors, hospitals and other health care providers. It unleashed innovation in the delivery of health care. Since its passage, the health insurance industry has invented a new business model selling coverage to anyone who applies, regardless of any pre-existing conditions.”

Meanwhile, The Hill reports that Trump has doubled down on abolishing the ACA.

New Study Says ACA Benefits Many Women

A new study published in the American Journal of Preventive Medicine concludes that the ACA has had “significant benefits” for women, with the greatest outcomes for low-income women.

The study found:

- Before the ACA, 40 percent of low-income survey respondents were uninsured. Afterward, that percentage dropped to 17 percent in 2014 and 11 percent in 2016.

- The number of women in the lowest income group who said they had seen a doctor within the past year increased by 4.1 percent after the ACA was introduced. There was also a 2.3 percent increase in the number of middle-income women who saw a doctor in the previous 12 months following the ACA rollout. (No significant difference for high-income women, though.)

- There were increases in blood pressure checks, cholesterol screenings and flu shots (between 3 and 7 percent) across all income groups after ACA policies went into effect.

- The number of low-income women getting mammograms to screen for breast cancer increased almost 5 percent.

Read more at MarketWatch.

MassMutual Intros MapMyFinances

MassMutual announced a new workplace financial and benefits planning tool to help workers assess and balance their short- and long-term financial needs. Called MapMyFinance, the tool is available automatically at no cost through employers that use MassMutual’s 401(k) or other defined contribution retirement plan services, voluntary insurance benefits or both. The tool provides users with a personalized financial wellness score to help them assess their overall financial situation and provides guidance to help workers prioritize their coverage choices based on their family situation and budget.

MassMutual says the need for financial education is acute. Thirty-seven percent of respondents to the company’s Middle America Financial Security study reported feeling “not very” or “not at all” financially secure, while the majority (54 percent) described themselves as “somewhat secure”. Furthermore, money worries accompany many Americans to work. Four in 10 study respondents (40 percent) said they worry about money at least once a week while at work. Half (51 percent) of Americans who are less affluent – those earning less than $45,000 – reported bringing their financial concerns to work at least once a week and 20 percent said daily, according to the study. Overall, nearly two-thirds (65 percent) of the respondents to the study said a financial emergency or major expense was one of their top worries. Overall, 22 percent of respondents cited debt as their top financial problem with more millennials and Generation Xers saying so. With age, healthcare costs rise in importance, becoming the No. 1 concern for baby boomers.

Climate Activists Deliver Petition to CDI’s Lara

The Insurance Journal reported last week that more than 60 environmental, consumer and social justice organizations delivered a petition to California Insurance Commissioner Ricardo Lara seeking what is believed would be the first regulations in the nation requiring insurance companies to disclose the fossil fuel projects they insure. The petition also asks Lara to expand disclosure of insurance companies’ fossil fuel-related investments. The California Department of Insurance’s Climate Risk Carbon Initiative currently requires disclosure of fossil fuel-related investments by insurance companies writing more than $100 million in premiums. Only a couple of readers commented on the Insurance Journal article, but they weren’t supportive of the action. Comments included: “Absolutely asinine” and “More Clown Show from Leftist Fascists.”

Medicare Beware: Wellness Visits Not Same As Physicals

Kaiser Health News reports that some Medicare folks are confused. And rightly so. Apparently, Medicare picks up the tab for a wellness visit, an ACA-mandated covered benefit. However, Medicare doesn’t pay for an annual physical, which may include lab tests:

“…if a wellness visit veers beyond the bounds of the specific covered preventive services into diagnosis or treatment — whether at the urging of the doctor or the patient — Medicare beneficiaries will typically owe a copay or other charges. (This can be an issue when people in private plans get preventive care, too. And it can affect patients of all ages. The ACA requires insurers to provide coverage, without a copay, for a range of preventive services, including immunizations. But if a visit goes beyond prevention, the patient may encounter charges.)”

Meanwhile, some Medicare Advantage plans cover annual physicals for their members free of charge. Good to know!

New Assessment Gives Insurers Innovation ‘Wellness’

ITL Advisory, the strategic consulting arm of Insurance Thought Leadership Inc., announced it is offering insurance companies a new innovation assessment service designed to evaluate whether their programs have critical elements for success—especially considering A.M. Best’s plan to begin evaluating insurance company innovation efforts.

Insurance rater A.M. Best recently released a draft of its proposed insurance innovation assessment process, kicking off a comment period before it formalizes the criteria and procedures that will form the basis for reviewing how comprehensive and effective an insurance company’s innovation efforts are.

ITL Advisory’s new assessment service is designed to provide insurance organizations with a quick, independent and confidential assessment of whether their innovation programs are on the right track and aligned with best practices, and that they contain essential elements to deliver a return on innovation investment. The assessment will help companies anticipate whether they are prepared for the Best review, or serve as a standalone check on their program elements. Companies can contact ITL about a complimentary assessment here.

The Workplace Blues: 5 Ways To Help Stressed-Out Employees

Problems with the emotional health of employees is costing employers up to $500 billion per year. As a result, the global wellness market is growing nearly twice as fast as the global economy, according to the Global Wellness Institute (GWI).

-

Review existing (or create new) core values, vision and purpose: When done right, these items are grounding pillars for a workplace.

-

Walk the Walk – Leadership’s role in change begins when leaders behave the way they expect their staff to behave. If one of your core values is “have integrity” and workplace leaders don’t act with integrity consistently, that’s a problem.

-

Invest in employees – Explore team activities that are pure fun, buy lunch once in a while, etc.

-

Monitor client feedback. Are your clients happy? If they aren’t happy, is it because your employees aren’t? Client feedback is the canary in the coal mine that your employees are not happy.

-

Don’t let employees suffer in silence. To reduce and prevent burnout, employers need to create a workplace culture that encourages employees to raise their hands and ask for help.

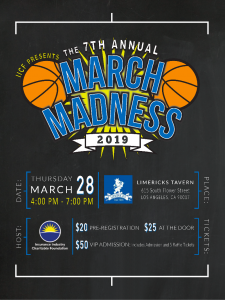

IICF March Madness- March 28

BenefitsPRO Broker Expo

April 2-4, 2019, Hyatt Regency, Miami, FL

A leading educational and networking event for employee benefits brokers and agents. Cultivate important relationships and obtain the most practical industry education for positioning your business for sustainable growth. More info here.

CAHU Women’s Leadership Summit -We’ll see you here!

April 3-5, Marriott, Las Vegas

Small group breakouts with introspective discussions focused on self care, relationships, and career success, lead by dynamic speakers, from both within and outside the industry. More info here.

LAAHU Annual Conference- We’ll see you here!

April 17, 2019, Skirball Cultural Center, Los Angeles. Register here. Exhibitor info here. Sponsorship info here.

LAAHU’s Annual Conference is the largest in the state and includes updates from D.C., breakout sessions for IFP, small group, large group, medicare and more!

CAHU Capitol Summit & Expo

May 20-22, Sawyer Hotel, Sacramento

Join CAHU in Sacramento at the Sawyer Hotel for information about California and the future outlook for the industry. Hear from Commissioner Lara, representatives from the Governor’s office, legislators, political insiders and more about where California is headed. Work alongside peers and other members as CAHU works to educate representatives on the critical role of the agent. Register here.

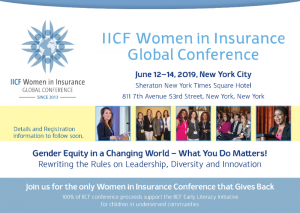

IICF Women in Insurance Global Conference

June 12-14, 2019, New York City