Get the most out of your email contact

NINE Tips as Open Enrollment Heats Up

People tune in differently — especially when you’re trying to alert them to OPEN ENROLLMENT! Variety works best. Engaging webinars and in-person meetings, clever SMS messages and mailers — use them all to catch employees attention with your open enrollment communication campaign. Here’s some things that maybe you haven’t thought of.

1. Give a heads up open enrollment is coming

2. Send a message communicating new benefits available

3. Call attention to plan features or changes

4. Announce your benefits decision support software

5. Offer one-on-one coaching

6. Celebrate the employer incentives being offered

7. Announce open enrollment kickoff

8. Help employees take advantage of their benefits

Tip: Creating a year-long calendar of healthcare literacy topics such as saving on medical expenses can encourage more employee engagement.

9. Send a satisfaction survey

Want to know more? Read full article

GOVERNMENT

Oops! Planned CMS email outage over Labor Day weekend

CMS will be performing a major email system transition over the Labor Day holiday weekend. This will cause an outage of CMS system emails starting late Friday, Sept. 2 till Tuesday, Sept. 6, early morning. The plan is for email to be queued and sent after the transition, but it is possible that some email may get lost. If you are waiting for a response, you may need to resend correspondence.

CMS grants $98.9M to health insurance exchange navigators

Health insurance exchange navigators will receive $98.9 million in grants from CMS for the 2023 HealthCare.gov open enrollment period – the largest ever. This historic investment builds on Biden-Harris commitment to enroll more people in healthcare coverage. These efforts contributed to the record-breaking 14.5 million people who signed up for 2022 health care coverage through the Marketplaces, including nearly 6 million people who newly gained coverage.

“We’re doubling down on our efforts to ensure people get the insurance they need,” said HHS Secretary Xavier Becerra. “Navigators critically help us reach people where they are, educating them on their health insurance options that can be lifesaving.”

Medicare Saves Over $1.6 Billion with Shared Savings Program

Through its work with Accountable Care Organizations (ACOs) — groups of doctors, hospitals and other health care providers — Medicare Shared Savings Program saved a massive $1.66 billion while continuing to deliver high-quality care. This marks the fifth consecutive year the program has generated overall savings and high-quality performance results. More info

Affordable percentage will shrink for employer health coverage in 2022

“The Affordable Care Act (ACA) benchmark for determining the affordability of employer-sponsored health coverage will shrink to 9.61% of an employee’s household income for the 2022 plan year — a decrease from the 2021 plan-year level of 9.83%, according to IRS Rev. Proc. 2021-36.” Read more.

Pandemic Over? Not for Employer-Sponsored Health Plans!

For employer-sponsored health plans, special “emergency” pandemic rules and extensions remain in effect. The Department of Labor guidance says many deadlines and health benefit election periods were extended until after the announced end of the COVID-19 National Emergency. Examples: HIPAA special enrollment period, COBRA election period, and deadlines to file, appeal, or request external review of claims. These periods and deadlines continue to be extended until the earlier of 60 days after the end of the National Emergency, or one year after a person became eligible for such extension. Read more.

What we’re up against

These 3 Healthcare Threats Will Do More Damage Than Covid-19

A trio of “mega forces” has arrived that now threaten to create healthcare’s version of the perfect storm. Without urgent and radical solutions, these forces will combine to produce a massive medical disaster—one that will prove far more destructive and costly than Covid-19:

Mega Force 1: Untamed Inflation

Mega Force 2: The Nursing Shortage

Mega Force #3: The Burnout Crisis

MENTAL HEALTH

Mental Health: Older Black and Latinx Adults in U.S. Health System Tell Their Story

Black and Latinx adults make up less than 20 percent of Medicare enrollees, and their perspectives may be underrepresented in national datasets, making it difficult to understand their unique health care experiences. To elevate their voices PerryUndem, a public opinion research firm, held 12 focus groups with 88 participants between July and October 2021, supported by the Commonwealth Fund. experiences seeking and receiving mental health care.

Reported Unmet Mental Health Care Needs

Black and Latinx adults often experience racism and a lack of respect in the health system, which can deter them from seeking mental health care. Racism itself has negative mental health impacts, including stress, anxiety, and depression, and racism in health care can lead to misdiagnoses as well as adverse physical health outcomes, including greater morbidity and mortality from chronic diseases.

What an Ideal Health Care System Might Look Like

Perspectives from Older Black and Latinx Adults

While nearly all Americans age 65 and older are covered by Medicare, their experiences seeking and receiving health care can vary significantly. Older Black and Latinx Medicare enrollees commonly experience racism when seeking care, report communication challenges with their providers, and have difficulty affording and accessing regular care. They are more likely to perceive their care as poor-quality.

Making up less than 20% of Medicare enrollees, Black and Latinx adults tend to be underrepresented in national surveys. Obtaining their perspectives on the health care they receive is a challenge. To elevate their voices and gain a better understanding of their experiences, the public opinion research firm PerryUndem, with Commonwealth Fund support, held a series of focus groups with Medicare enrollees age 65 and older between July and October 2021.

Highlights

- Patients who feel disrespected by health care providers do not adhere as well to their treatment plan and have greater mistrust of health professionals.

- Conversely, patients who say their provider treats them with dignity are more likely to use preventive services.

HEALTH CARE COSTS

Reducing skyrocketing hospital costs

Hospitals are cutting services and laying off workers in the face of rising inflation and declining federal aid, forcing patients to travel further to receive care. Get the story from Katheryn Houghton, Kaiser Health News.

YIKES .. Inflation is (finally) hitting health care

While health care prices have so far been largely unaffected by record-high U.S. inflation, prices will likely increase more quickly going forward, leading to higher insurance premiums and more costly services for both consumers and employers in 2023. Read more.

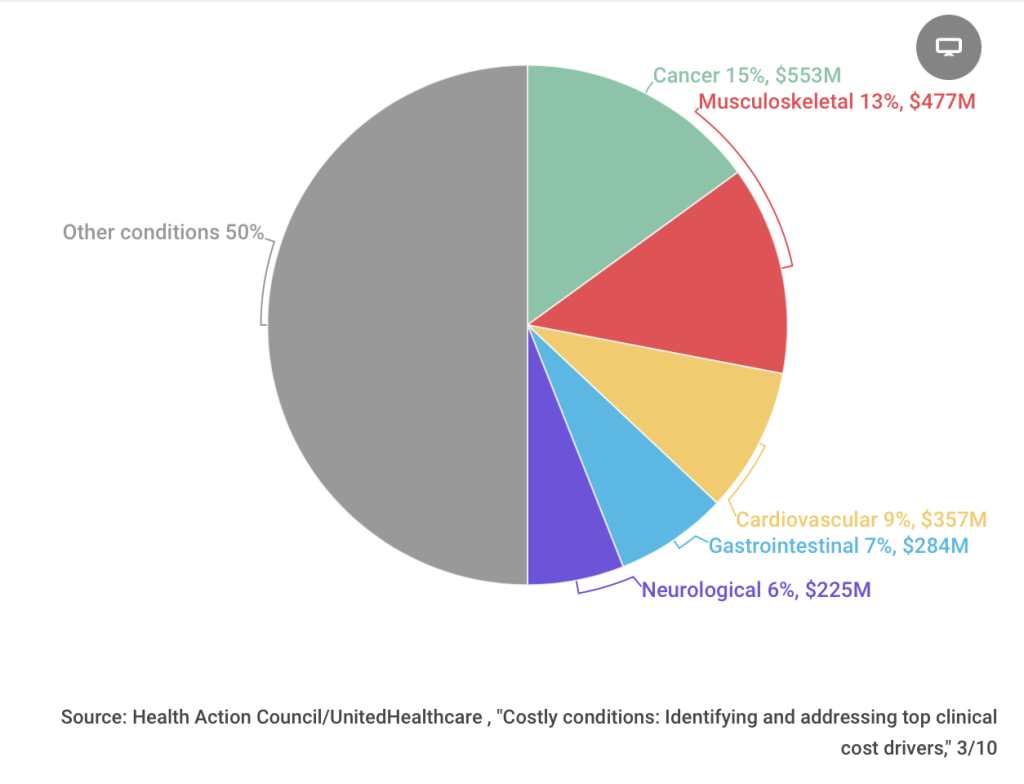

Related: The 5 conditions driving health care spending, charted

BENEFITS

Wuff Wuff: Top 9 Best Pet Insurance Companies

Want to add pet insurance to your offerings? Here’s a great resource for the top 9 best companies to work with. Click here.

WHO’S WHO

BenefitMall Acquires Mutual Med, Strengthening Midwest Presence

New carriers, lines of coverage, and expanded voluntary benefits offerings

BenefitMall acquired Iowa-based Mutual Med to expand and strengthen their Midwest presence and adding eight new states to BenefitMall’s footprint. Clients will benefit from a wider range of carrier and network relationships, as well as expanded voluntary benefits offerings as a result of the acquisition.

Mutual Med will operate as a division of BenefitMall, continuing under its current name and leadership. The combined presence provides service in 24 states to agencies selling in 48 states. The acquisition follows the announcement earlier this month that BenefitMall has been acquired by CRC Group, rounding out CRC Group’s portfolio with employee benefits solutions.

More info: www.benefitmall.com.

Blue Shield of California names Sandra Clark COO and Mike Stuart CFO

These promotions are made to help drive the nonprofit health plan’s operational excellence and ambitious healthcare transformation plan. Clarke has been serving as the health plan’s EVP and CFO. With Clark’s appointment as COO, Mike Stuart, Blue Shield’s SVP of operations finance, has been promoted to the role of the CFO and will report to Clarke. Read more.

Icario Names Bryan Perler Chief Financial and Administrative Officer

Former Zelis and Sapphire Digital Executive Brings a Proven Track Record of Driving Growth and Profitability at Scale

Icario, the healthcare industry’s largest health action company named Bryan Perler chief financial and administrative officer, reporting to CEO Steve Wigginton. Perler most recently held the same positions at Sapphire Digital, the medical cost transparency subsidiary of Zelis, a healthcare payments technology company. In his new role, Perler will lead Icario’s accounting and finance, human resources/talent, legal, compliance and regulatory teams. For more information on Icario’s health action capabilities, visit www.icariohealth.com.

FEATURED WEBINAR

NAHU Compliance Corner webinar Sept. 23, at 10 a.m. PST/1:00 p.m. ET. Benjamin Davis, VP of IRS & DOL Compliance at Diversified Administration’s will provide an in-depth look at IRS letters 226-J and 5699. Register.

EVENTS

- WIFS-Los Angeles & NAIFA-Los Angeles present “Bust Those Myths About Life Insurance” as part of Life Insurance Awareness Month. Sept. 8, 2022 11:30 a.m. – 1:30 p.m. PST by Zoom. Register

- OCAHU Annual CE Day, Sept. 13, 9am – 4pm. Earn 5 CEs. Register

- DCAHU Annual Medicare Summit, Sept 15, 10-3pm, Palm Desert, Register

- LAAHU 7th Annual Medicare Symposium, Sept. 15, Burbank Marriott Hotel, Register

- NAIC Insurance 2022 Summit (in person & virtual), Sept.19-23, Kansas City. Register

- InsurTech Connect: The Future of Insurance is Here, Sept. 20-22, Las Vegas. Info here

- CAHIP Virtual Medicare Event, Sept. 21, 10 a.m.-1 p.m. Register

- WIFS National Conference, Sept. 29-Oct. 1, Phoenix, Arizona. Info here

- National African-American Insurance Association (NAAIA) 2022 Annual Conference & Empowerment Summit, Oct. 5-7, Baltimore, MD. Info here

- Self Insurance Institute of America (SIIA) ENGAGE National Conference & Expo, October 9-11, Phoenix. Info: (800)851-7789 www.siiaconferences.org

- Life Insurance Marketing and Research Association (LIMRA) 2022 Annual Conference, Chicago, Oct. 16 – 18. Register

- HLTH 2022 Health Innovation Expo, Nov. 13-16, Las Vegas. Register

- Ellevate Women’s Leadership 2023 Summit, March 13-15, 2/23. JW Marriott just outside Las Vegas. Register

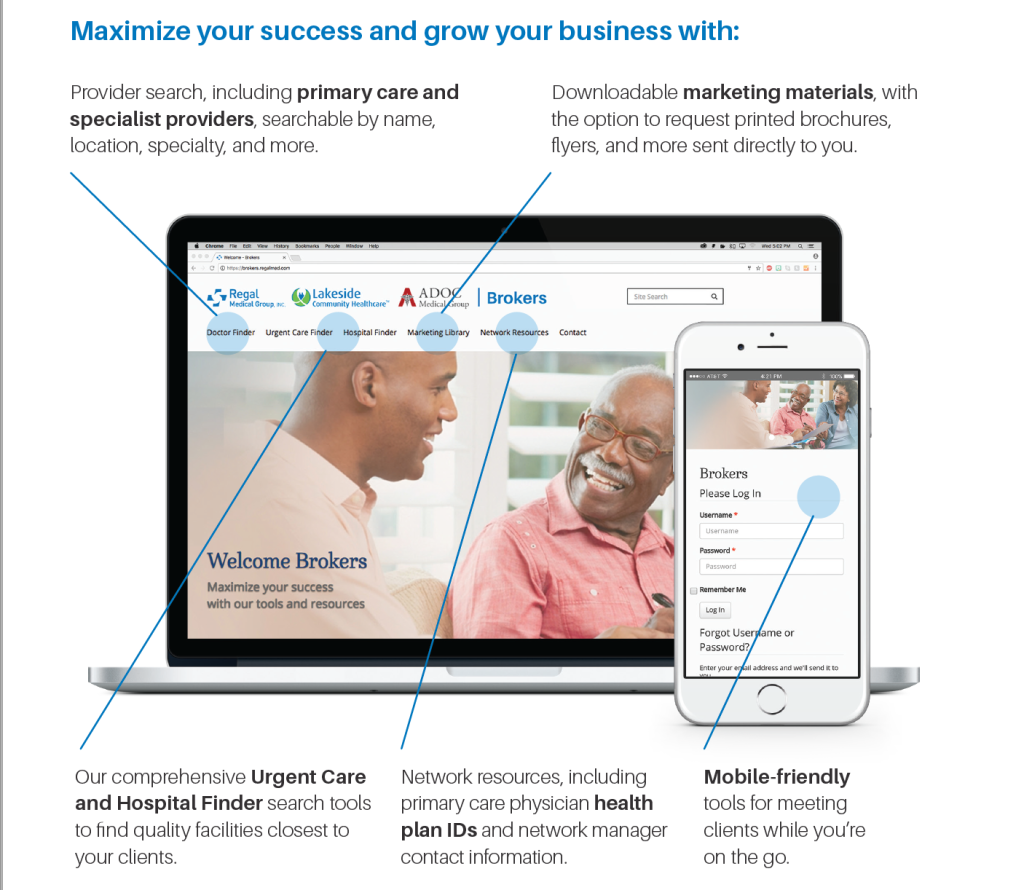

Regal Medical Group looks forward to partnering with you during open enrollment as you continue to bring quality healthcare benefits to your clients throughout Southern California.

Regal Medical Group looks forward to partnering with you during open enrollment as you continue to bring quality healthcare benefits to your clients throughout Southern California.

Visit regalmed.com and click on “Brokers.” More info here.

Questions? Email BrokerInquiry@regalmed.com

CALIFORNIA BROKER September Print Magazine coming to your mailbox soon: Life Insurance Awareness Month, Finding the Right Buyer for Your Agency, OC Consumer Education Efforts, and more! Sign up for a monthly print subscription by sending your physical address to: Calbrokermag@calbrokermag.com

Read more about the program

Read more about the program