BY PHIL CALHOUN with MAGGIE STEDT

This is a two part article with Part One covering the rising competition in the Medicare market and Part Two outlining competitive actions local independent brokers can take to highlight their unique strengths and expose the weaknesses of larger competitors.

Phil Calhoun:

While Maggie Stedt and I both operate as independent brokers and focus on health insurance with an emphasis on Medicare, Maggie’s work at the local and state level

with our professional association (CAHU) is special and has benefited all brokers. For me, moving from 20 years as a retail health broker deeper into consulting with brokers on Commission

Protection and Exit Planning, I bring both 20 years of experience with Medicare clients and a recent direct experience in the Medicare marketing blitz (I turned 65 last June). So we both have significant input to offer our readers on this topic.

When it comes to Medicare marketing and competition we know our friends can be competitors as well. The direct marketing carriers and healthcare providers perform is growing. I experienced this and more in my mailbox! The numerous mailers sent to me all teaching about being 64 and needing to call for information or to enroll has made quite a varied collection. It does not stop as I still see mailers well past my enrollment window and all suggesting the sender has something to offer — “it’s not too late to call!”

Maggie’s industry service work for years and interest in this Medicare related topic is why we chose to collaborate on an article directed at the Medicare market and the independent local broker. Maggie’s CAHU and OCAHU connections add a special and unique insight brokers can benefit from as she not only pioneered the Medicare Summit but traveled statewide networking with numerous Medicare professionals including local brokers.

What makes this enjoyable is that we are both focused on a common goal: to help brokers learn and compete through raising their expertise and professionalism in order to make a difference with consumers.

When the mailers came I was surprised to see where some came from. The mailers from carriers, my fellow brokers and health care providers were expected. Surprisingly the competitors I did not expect were active as well, like my alumni association, eHealth and other dot coms, WalMart Insurance Services, my home and auto broker, my pharmacy, CVS and GoodRx, and, I was even called, mailed and emailed by Blue Shield where I had my previous group medical plan. At least now I know my group clients are being called by Blue Shield captive employee representatives who enroll in the same plans independent local brokers do. Just one more competitor, inside your book of business I thought!

COMPETITION LEADS TO ACTION

All of these mailers, and carrier phone calls, serve as motivation all brokers can use to take action. “Brokers must be proactive with their IFP and group clients who reach

64. Begin with a personalized education program on the value an independent local broker brings to clients,” says Maggie. “Of course Kaiser members are not likely to work with local brokers in most of California. So, spending time communicating and building relationships with your individual and group clients will lead to enrollment in either a Medicare Supplement plan or an MAPD,” she suggests.

WHY DO SO MANY COMPETITORS TARGET CALIFORNIA?

“California MAPD commissions are among the nation’s highest. This is why some competition is coming from outside the state and also why local providers and the health plans are attempting to enroll or steer members and patients to seek enrollment with them,” Maggie explains.

In our next article we will outline how the out-of-area competitor’s “enroll and run” approach can be addressed as local brokers focus on educating consumers. “We have the expertise to enroll people in most if not all of the MAPD plans. We can make sure clients access their doctors and hospitals. This is a significant and valuable difference for consumers,” shares Maggie.

One final area to address is the increasing competition from medical groups, health care systems and health plans. The actions they take to directly target clients and patients, many who were enrolled by local brokers, are an attempt to move them to Medicare plans they prefer. The financial incentive of the capitation dollars, which exceed $1,000 a month per member, is the reason for the aggressive targeting of Medicare Supplement policyholders designed to enroll them in a MAPD. The direct marketing occurs without concern about the impact on the local broker who represent many of the people targeted with phone calls, mailers and emails.

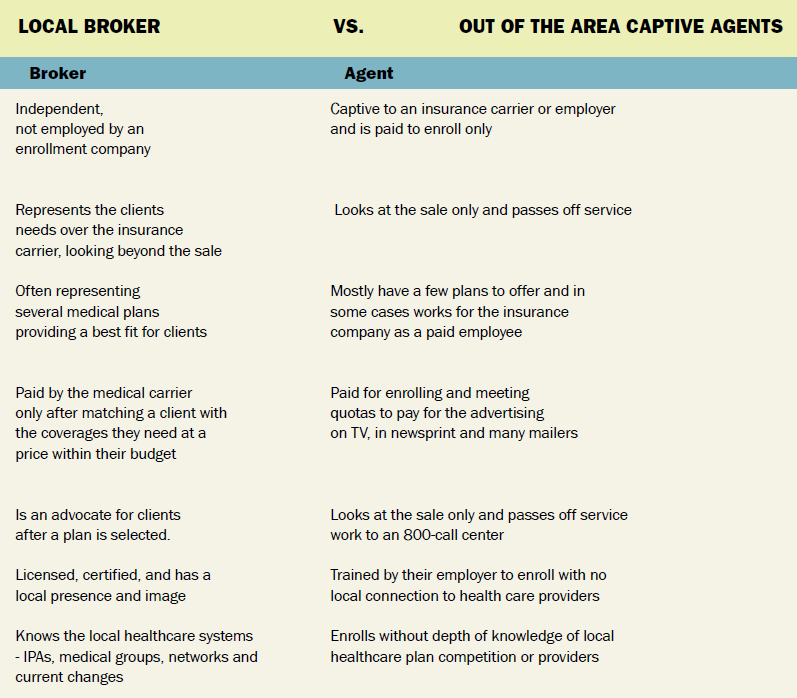

The chart below outlines key reasons why local brokers are better able to help local individuals.

Maggie asserts, “We provide both local medical plan knowledge and provider intelligence as well as a far stronger commitment to personal service.”

“Local brokers provide service and support to help clients get their healthcare needs met,” says Maggie. “As we consistently perform this “client first” role we prove we truly are advocates for our clients. The failure of a call center enroller is they rarely provide service support and instead use an 800 option which is not local. This can void of any local connections or the knowledge needed to address their health access needs. This is why consumers end up stuck between the opposing agendas of the carriers and the health care providers. This can leave the individual spinning around and often results in dissatisfaction and giving up. The 800 help line is no solution for issues that need a local personal touch to resolve. Enter the local independent broker advocate.”

Part Two will focus on what areas local brokers can compete in through differentiation. We will outline collaborative steps to take that will rally local brokers to collectively send a consistent message about their unique offering to consumers. It is time local Medicare beneficiaries know about what local brokers offer and why they need to look deeper at working with a local independent broker.

PHIL CALHOUN published “The Health Insurance Broker’s Guide: How to Protect, Grow and Sell Your Commissions” last year. His goal is to help active brokers reach 100% commission protection and retiring brokers make the exit planning process work for them. Phil consults with brokers statewide and offers his eBook free online at www.healthbrokersguide.com

PHIL CALHOUN published “The Health Insurance Broker’s Guide: How to Protect, Grow and Sell Your Commissions” last year. His goal is to help active brokers reach 100% commission protection and retiring brokers make the exit planning process work for them. Phil consults with brokers statewide and offers his eBook free online at www.healthbrokersguide.com

Contact: phil@integrity-advisors.com or call 1-800-500-9799 to schedule an appointment and get your personal questions answered.

MAGGIE STEDT is an independent agent that has specialized in the Medicare market for the past 21 years. She is currently president of California Association Health Underwriters (CAHU) and is a past president of her local Orange County Health Underwriters Association (OCAHU) chapter. Reach her at maggiestedt@gmail.com