Protect Your Commissions in 2022

BY PHIL CALHOUN

I AM OFTEN ASKED how commissions are handled when an active broker retires or worse, is no longer able to stay active. The answer is the same no matter if a broker has a partner, owns or works in an agency, or works solo and either has or does not have a corporation.

All health benefits brokers while active need a successor to protect their commissions in all life events so you and your loved ones will be taken care of.

Many brokers have expressed concerns about what a successor does, how to find a successor, and if an agreement with their successor is needed. Other brokers say they have a successor. In some cases it is a spouse or child, in other cases an employee. No matter who you have as your successor, you need a written agreement. Active brokers who complete a written agreement with their successor are on the way to 100% commission protection.

A successor has a responsibility to back you up when you need it most and agrees in writing to pay you or your loved ones for your commissions at the amounts outlined in the financial agreement you reach. Your successor should be able to step into your shoes at any time and complete the plan you and your successor mutually agreed to.

Considerations for your Successor:

• Personality fit for you and your clients

• In 100% alignment with your personal and estate planning needs

• Is not pushing you to transfer your commissions while you are active

• Has experience with service and support of client’s needs

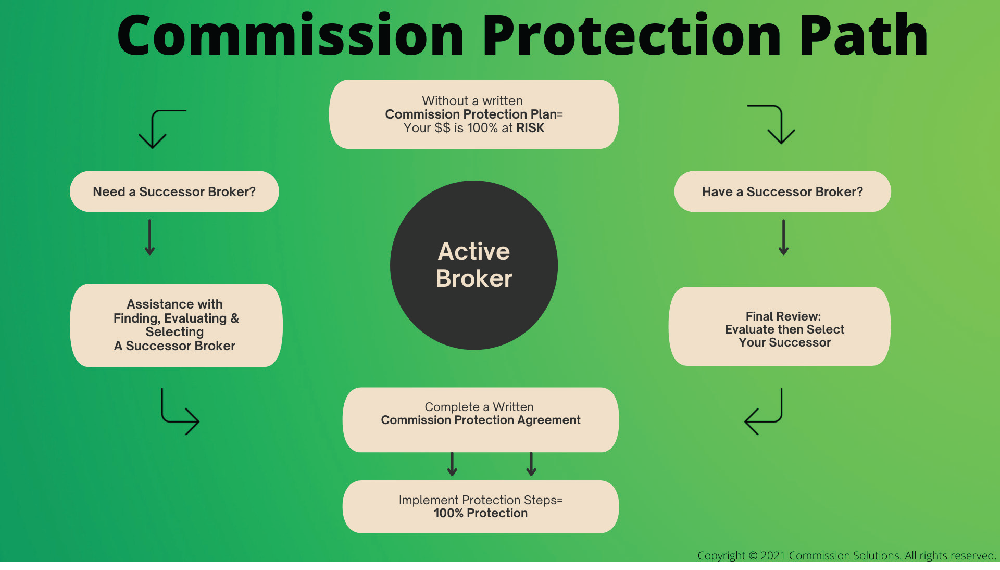

The commission protection process we suggest brokers pursue is outlined in the flow chart above.

All health benefits brokers while active need a successor to protect their commissions in all life events so you and your loved ones will be taken care of.

- Youthful, enthusiastic, energetic, and excited about health insurance

- Has the capacity to handle your clients

- Has a team in place with at least two certified and licensed health insurance professionals

- Has track record of success

- Is capable of handling renewals and retention

- Is willing to use your successor agreement

- Accepts the responsibility of their role as successor as defined in your agreement

- Has all of the transfer and assignment documents required of all the carriers you receive commissions from

- If your book is over 350 Medicare members or over 20 small groups or a combination of the two, your successor should commit to either hire your staff or add a support person to do the job.

Phil Calhoun published “The Health Insurance Broker’s Guide: How to Protect, Grow and Sell Your Commissions” last year. His goal is to help active brokers reach 100% commission protection and retiring brokers make the exit planning process work for them. Phil consults with brokers statewide and offers his eBook free online at www.healthbrokersguide.com

Contact: phil@integrity-advisors.com or call John Evangelista at 714-308-0669 or 800-325-4368 to schedule an appointment and get your personal questions answered.