How a Millennial and Baby Boomer joined forces

Q&A with Patrick “PJ” Johnson and Stephanie Dannebaum

By Linda Lalande

There has been an increasing trend in recent years for cross-generational partnerships to form, particularly between Baby Boomers and Millennials. Many Baby Boomers are interested in transitioning out of their current roles and may be seeking a successor to take over their business, while Millennials may be looking for opportunities to start or own their own business. Boomers bring wisdom, bring years of experience, knowledge, and established networks to the table. Millennials often have strong digital skills, fresh perspectives, and a willingness to take risks. When combined these qualities can create a powerful partnership that can lead to business success.

Linda Lalande, Calbroker editor (CB): What inspired you two to launch a business venture?

Patrick “PJ” Johnson (PJ): I hosted a long-term care (LTC) seminar to help educate financial planners and advisors about the importance of LTC as well as various strategies and products available for their clients. A colleague who attended the LTC seminar introduced me to Stephanie Dannebaum. She was the resident expert of all insurance needs for clients at a fee-only firm in the San Francisco bay area. At that point, we started working on various client cases together.

In 2020, Stephanie decided to step back from her role as a junior advisor to start a family. We stayed in touch and about a year ago decided to team up to help fee-only Registered Investment Advisory (RIA) firms provide risk management strategies for clients. We became strategic partners of fee-only for RIA firms and now provide insight and strategies that align with the client’s financial and estate plans.

CB: What’s behind this unusual partnership?

Stephanie Dannebaum (SD): We decided to become partners because we saw an opportunity to provide fee-only financial planners risk management education and expertise from an unbiased, independent position. We see the RIA space as open, free, independent and unrestricted. We form relationships with these firms and build trust with their clients.

CB: WHAT ARE YOU ACTUALLY DOING? DESCRIBE THE BUSINESS ITSELF.

We are doing actual retail sales to the client. We have access to hundreds of products through CPS Sacramento, our general brokerage agency. This allows us to bring independent product solutions to the client. We handle the case start to finish. From the first client conversation to case design, proposal generation, presentation, application, underwriting and case management to delivery of the policy and placement. As a partner to financial planners, we work also with the client’s CPA, estate planning attorney, and of course their children.

CB: HOW IS IT WORKING?

Our approach is working really well. We hold educational seminars to train financial planners on the importance of risk management strategies to align with a clients financial and estate plan. We conduct these training seminars to meet new RIA’s and then follow up with a visit to their office to get better acquainted. We also are active in the local FPA associations and estate planning councils and the Next Gen movement — more informal social events hosted by young financial planners, like Stephanie.

Once a financial planner identifies a client that has a risk management need, they connect with us to discuss their needs. We then speak with the clients to learn more about them and review their goals.

When we receive basic information from the client, we review and initiate an application with the provider selected. We walk the client through the whole process and ensure transparency.

CB: WHAT ARE THE PAIN POINTS AND MOMENTUM POINTS OF THE VENTURE?

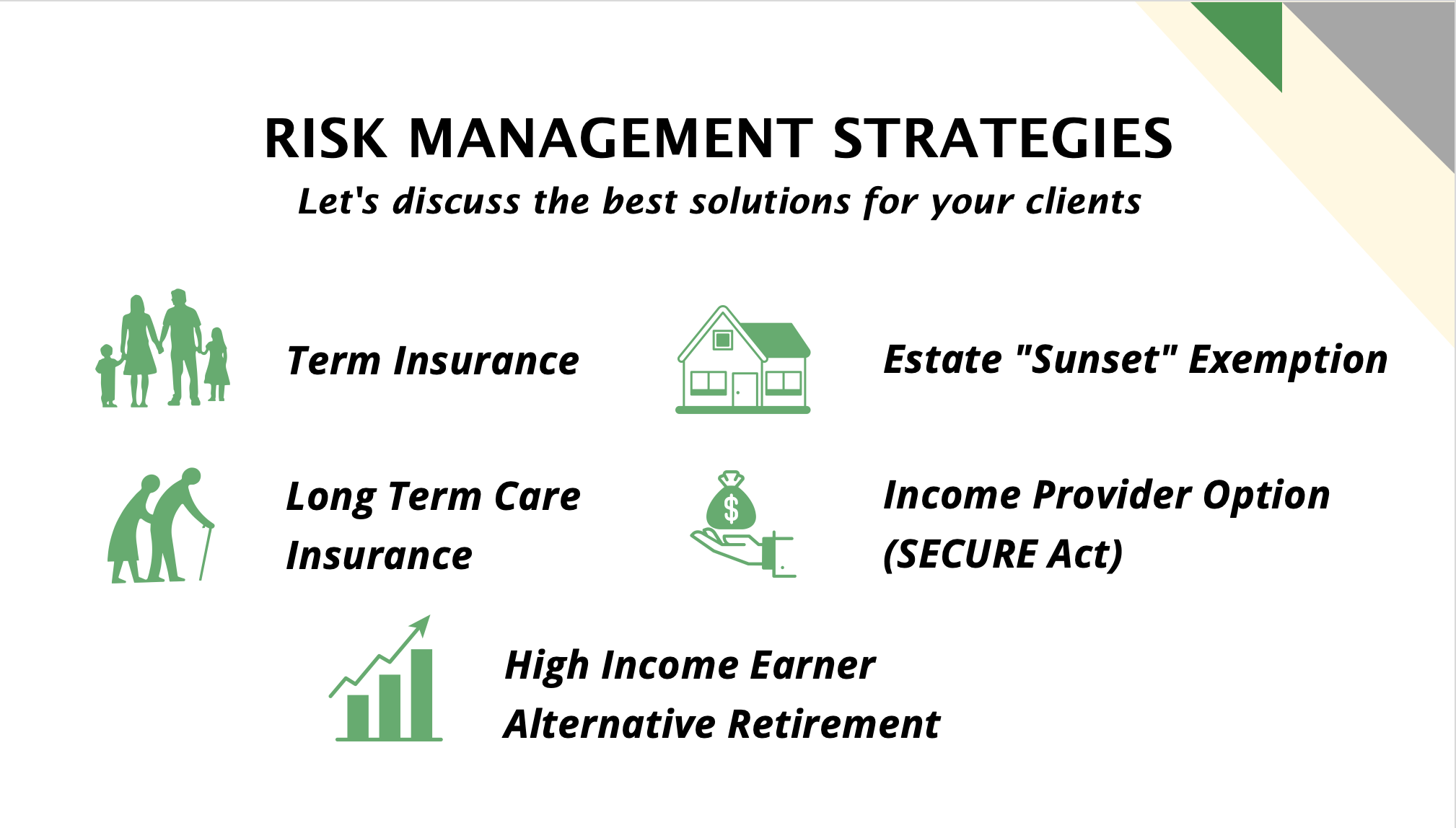

Our business model is focused on providing education to fee-only RIF. We decided to initiate our venture during the height of the pandemic, therefore our in-person seminars did not receive the attendance we were anticipating. Thankfully, we have seen more participation in this post-pandemic era to show our value. Once we show RIA firms our five core strategies to mitigate risk in a client’s life, we are able to show them that we do not focus on products, but solutions. In 2023 the focus on training will be around estate tax planning for high net worth clients and planning around the new Secure Act and required minimum distribution (RMD) planning using life insurance.

CB: IS THE SUCCESS BECAUSE OF THE COMING TOGETHER OF TWO GENERATIONS?

PJ: I believe the experience each of us brings to the table is our strength. My experience with Transamerica, Smith Barney, City Bank and Met Life for over 30 years in the estate planning department combined with Stephanie’s experience with financial planning with RIA firms is a perfect blend to provide clients the best solutions to achieve their risk management strategies. We approach insurance through the lens of estate planning and achieving a client’s goal and by not pushing products. We also love the idea that once I retire, Stephanie will be the agent of record to help the client with any policy holder service needs in the future. We split the commission on all applications 50/50.

CB: WOULD THIS BE A MODEL FOR OTHERS TO FOLLOW?

Yes — we believe our business model aligns with a financial planners holistic and fiduciary responsibility to provide clients with transparency and the best solutions to achieve their financial goals. We view our strategic partnership as a way for both of us prosper by providing value mutually to the financial planner and the client. Our intergenerational approach appeals to clients, and illustrates how professionals can work together to support consumers and thrive in a challenging economic environment.

PATRICK “PJ” JOHNSON is an independent life insurance agent and does sales and marketing for CPS Sacramento. PJ has been a NAIFA member since 1984. He is a past board member of the Greater East Bay chapter and past board member of the Sacramento FPA Association. He has CLU and CLTC designations.

Contact:

(925) 200-9482

pj@cpssac.com

STEPHANIE DANNEBAUM is the founder of Stephanie Dannebaum Consulting, a CRM Implementation consulting firm. She helps Registered Investment Advisory (RIA) firms successfully implement customized client services. Stephanie spent nine years in the financial services industry in operations, investment management, and financial planning for fee-based and fee-only advisory firms. In 2020, she joined PJ Johnson as a strategic partner of Independent Registered Investment Advisory (RIA) firms to provide risk management strategies that align with their client’s financial and estate plan.

Contact:

925-322-0174

stephanie@stephaniedannebaum.com

www.stephaniedannebaum.com