Big news: California Insurance Commissioner Ricardo Lara will headline the Los Angeles Association of Health Underwriters annual symposium! The meeting is virtual May 13-14. The theme is Stay Positive & Be Happy. There will be plenty of networking opportunities and lots of CE courses. Visit LAAHU’s website for registration and sponsorship opportunties! See you at the symposium.

Also in May

Don’t forget that SDAHU has a May 6 event and CAHU’s Capitol Summit is May 17-19. Both events are virtual!

COVID

Life After Vaccination

The folks at CurexLab, one of the largest suppliers of COVID-19 PPE and lab supplies, recently sent us some commonsense safety info for the 212 million people who have received COVID vaccines. CurexLab says that even if you’re fully vaccinated you should still:

- Continue to make hand washing a priority.

- Wear a mask in public places where there will be others nearby.

- Avoid large crowds and especially those that are indoors or are in poorly ventilated areas.

- Avoid those who may be at an increased risk for COVID or other illnesses.

- Adopt healthy lifestyle habits, such as eating healthy, getting plenty of physical activity, and losing weight if you have extra pounds.

- Be sure to take sanitizing wipes along to clean your immediate area when traveling, and take hand sanitizer with you for when you can’t find a sink right away.

COVID Delays REAL ID Enforcement

Most of you have probably forgotten about the new REAL ID requirement for airline travel. Welp, that’s okay because the U.S. Department of Homeland Security announced an extension of the REAL ID deadline from Oct. 1, 2021, to May 3, 2023. The DMV is still trying to catch up from COVID.

MONEY&LIFE

April is Financial Literacy Month. How Much Do You Know?

This will not be news to anyone out there who is a financial planner: Americans aren’t very financially astute. Newly released LIMRA research finds that just 1 in 8 have a high level of financial literacy. That’s based on a 10-question quiz provided to nearly 1,000 American adults.

From LIMRA:

This aligns with consumers’ self-reported knowledge from a prior survey (only 12% said they have a high level of knowledge). The quiz revealed that more than a third of consumers answered three or fewer questions correctly and, on average, Americans answered only four questions correctly.

Testing for financial literacy is not just a novelty — LIMRA research shows a correlation between higher knowledge of financial topics with increased life insurance ownership and likelihood to save for retirement.

New research from the 2021 Insurance Barometer Study shows only about a third of consumers reported a high level of knowledge about life insurance. Women and Baby Boomers reported the lowest levels of knowledge. The power of knowledge is illustrated by the fact that 41% of those who said they are ‘very’ or ‘extremely’ knowledgeable own life insurance, while to just 19% of non-owners say the same.

Would you like to test your own financial literacy? Take LIMRA’s quiz here.

Lastly, here’s some motivation for life agents: today, just 52% of Americans own life insurance and many more don’t have enough coverage. There are 102 million uninsured and underinsured Americans who believe they need more life insurance. Go get ’em.

JOBS

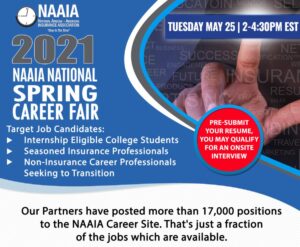

NAAIA Spring Career Fair

The National African American Insurance Association is hosting a career fair on May 25, 11-12:30 PT. (Note that the organization is based on the east coast, so we’ve translated the time.) Looks like they’ll have everything from internship to seasoned pro opportunities. Register here.

CHIRO/ACU

Landmark Issues Broker Update

Effective August 1, 2021, Landmark Healthplan announced a rate increase by 6% for all new business and all renewing business with 2-199 enrolled subscribers. Groups with 200+ enrolled subscribers will continue to be experienced rated. Landmark Healthplan has also announced an increase to the standard commission from 10% to 20% of paid premiums for the first year on all new business. Send RFP to this email: sales@LHP-CA.com.

BUNDLING

UnitedHealthcare Announces Upgrade to Integrated Plans

UnitedHealthcare recently announced enhancements to its integrated health plans including:

- Potential Premium Savings and Net Cost Guarantee. For employers with self-funded health plans (more than 300 employees) that integrate medical and specialty benefits, UnitedHealth now offers a Net Cost Guarantee. Employers receive an administrative fee credit if actual health care costs exceed projections. Separately, the premium savings program uBundle® enables certain employers with fully insured plans to save up to 4% per year on medical premiums when combining UnitedHealth’s medical plan with specialty benefits such as dental, vision, life, disability and supplemental health coverage (accident, critical illness and hospital indemnity plans).

- Launch of UnitedHealthcare Benefit Ally™. Benefit Ally is designed to simplify payouts for employees whose employers combine three supplemental health plans with medical benefits. Following a qualified accident, critical illness diagnosis or hospital stay, Benefit Ally automatically triggers a payout to the member – all without the plan participant having to submit a claim or additional paperwork.

Expanded Resources for Employers. Later this year, vision, dental and financial protection aggregate claims information will be added to Health Plan Manager™, an interactive online tool. The tool enables employers to analyze and understand health data.

INSURTECH

Oscar Launches +Oscar

Insurtech company Oscar Health announced its launching a new business called +Oscar. The new business will offer providers and third-party payors access to Oscar’s tech-enabled insurance platform.

EVENTS

- CAHU Statewide Leadership Conference, Virtual, April 28-29. Agenda here. Register here.

- San Diego Association of Health Underwriters Sales Expo, Virtual, May 6. Info here.

- Los Angeles Association of Health Underwriters Annual Symposium, Virtual, May 13-14. Sponsorship info here. Register here.

- CAHU Capitol Summit, Virtual, May 17-19, Info here.

-

IICF International Inclusion in Insurance Forum, June 15-17. Register here.

- BenefitsPro Broker Expo, virtual one day May 18 AND in person in San Diego, August 16-18. Save 15% with promo code RIGHTPLAN. Agenda here, register here.

- American Association for Medicare Supplement Insurance, National Medicare Supplement Insurance Industry Summit, Sept 8-10, Schaumburg Convention Center, Chicago area. Info here