Our bet for most interesting California insurance news of the week involves lots of data! Researchers at West Health Policy Center released a study that found private insurers paid hospitals in California on average more than double what Medicare paid them for similar services in 2015 and 2016.

Analysis of financial data filed by hospitals with the California Office of Statewide Health Planning and Development (OSHPD) found substantial variation across hospitals in the relationship of private insurance payments to Medicare. For the 10 percent of California hospitals with the highest ratio of private to Medicare payments, private insurance payments average 364 percent of Medicare and 255 percent of cost; for the 10 percent with the lowest ratio, the average is 89 percent of Medicare and 89 percent of cost. Among hospitals with more than 300 beds, the 10 hospitals with the highest ratio of private to Medicare payments include Stanford University Hospital, U.C. Davis Medical Center, and Cedars-Sinai Medical Center.

So what does this mean? Researchers Richard Kronick and Sarah Hoda Neyaz offer two perspectives. The first perspective is that basically hospitals charge insurers 209 percent of Medicare on average because they can. Among the reasons: insurers need a broad network or they won’t get anyone signing up for their plans. Considerable research supports this view.

In this perspective, relatively high payment rates extracted from private insurers allow hospitals to spend more money – that is, have higher costs – than they would if private payments were lower. High rates of private payments lead to higher costs, which then cause Medicare and Medi-Cal payments to be below cost. In this perspective, if private payments were lower, hospital costs would be lower, and Medicare and Medi-Cal payment-to-cost ratios (PTCRs) would be closer to 1.0.

The second perspective is that hospitals charge the high rates because it’s the only way they can stay in business. Private payers account for 27.6 percent of total hospital cost. The surplus from private payers picks up the bill left from public payers and the remaining uninsured, usually resulting in a small positive margin.

Stay tuned. The researchers intend to provide more info that will be helpful in getting to the bottom of the matter. In the meantime, read the whole report here. Hospital-specific results are available here. West Health Policy Center is a San Diego and D.C.-based nonprofit focused on lowering healthcare costs and helping seniors age in place.

GA Warner-Pacific Unveils New Look

Westlake Village, California-based Warner Pacific, a general agency that provides resources and support for health insurance brokers, unveiled a new look, complete with an updated logo. The new branding is aimed to reflect the company’s continuing dedication to its clients and insurance carrier partners, while also communicating its commitment to staying at the forefront of the rapidly changing insurance marketplace, according to the company.

Cal Department of Managed Care Releases Annual Report

The California Department of Managed Care recently released its annual report. We’re happy to pass along little infographic:

Healthcare.Gov Agent/Broker Conference Will Happen Same Day as NAHU conference

Interesting coincidence. The Centers for Medicare and Medicaid Services announced that the 2019 CMS Marketplace Agent and Broker Summit— that is, the Healthcare.gov summit– will take place July 1 at CMS headquarters in Baltimore. That’s right smack in the middle of the National Association of Health Underwriters annual conference. Speaking of which…

NAHU Conference Coming to San Diego

The National Association of Health Underwriters is holding its annual convention in California this year. The event will take place June 28-July 2 at the Sheraton San Diego Hotel & Marina. There will be personal and professional growth forums. Sessions focus on practical solutions for your business, including retaining today’s new workforce, buying or selling your agency, data transparency and alternative healthcare management. There’s also an expanded Medicare Extreme! with proven practices and important trends on changes in Medicare, technology solutions, growing your business with group Medicare sales plus more. More info here. See you in San Deigo!

Millennials Disrupting Healthcare?

Transamerica Center for Health Studies (TCHS) released a new report titled Millennials: An Emerging Generation Disrupting Healthcare. The research concludes that millennials are far more aware of health policy than previous generations and they access care differently. Key findings include:

- Many millennials are unhappy with the quality of their healthcare and less reliant on healthcare expert. Twenty-one percent say they are “not at all” or “not very satisfied” with the quality of healthcare to which they have access — a dissatisfaction that has increased since 2016.

- Millennials reported visiting their doctor’s office less often, due to the dissatisfaction, coupled with limited finances (31 percent with no visits vs. 27 percent of Gen X and 19 percent of Boomers) often than older generations from 2015-2018.

- Millennials are more likely to visit a mental health professional, however. More than older generations, in the past twelve months millennials are more likely to have one or more mental health visits (20 percent vs. 11 percent of Gen X and 7 percent of Boomers).

- Millennials are more likely to save for healthcare expenses and more aware of potential changes to health policy. Thirty percent say they are extremely or very aware of healthcare policy changes (20 percent of Gen X and 20 percent of Boomers), of which most (57 percent) are extremely or very concerned about these policy changes.

Extra: Allison Bell at Think Advisor has this up about the soaring rate of uninsured millennials.

Health Insurance Inflation Hits High

The Consumer Price Index for health insurance in April spiked 10.7% over the previous 12 months—the largest increase since at least April 2014, according to a Modern Healthcare analysis of the U.S. Bureau of Labor Statistics’ unadjusted monthly Consumer Price Index data. From Modern Healthcare:

The likely reason health insurance inflation is rising is because of growth in managed care, including Medicare Advantage, Medicaid managed care and commercial insurance, according to Paul Hughes-Cromwick, an economist at Altarum. He noted that added administrative costs increase insurance price growth.

EBN Seeking Nominees for Top Women in Advising

Know any women in the industry who are at the forefront of improving benefit and healthcare plans for employers, advising influential leaders and innovating in an industry under transformation? The editors at Employee Benefits News want to hear all about them! Nominate your female colleagues here. Winners will be recognized at EBN’s July 22-24 Workplace Benefits Mania conference in Las Vegas. Deadline for nominations is May 27.

LIFE

Advocates Want GINA to Extend to Life

Since 2012, the California Genetic Information Nondiscrimination Act –CalGINA– has prohibited genetic discrimination in employment, housing, mortgage lending, education and public accommodations. CalGINA provides broader protections for employees than does the federal Genetic Information Nondiscrimination Act (“GINA”) of 2008, which is limited to health insurance and employment discrimination coverage. Still, genetic testing advocates would like to see discrimination protections extend to life and long-term care insurance. Right now there’s no law that prohibits insurers from asking potential customers about results from services such as 23andme or rating based on said results. This article on Bloomberg Law says it’s a long shot that GINA will be extended to life and LTC any time soon.

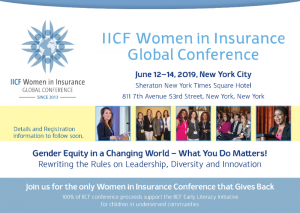

IICF Women in Insurance Global Conference

June 12-14, 2019, New York City

NAHU Annual Convention –We’ll see you here!

June 29-July 2, Sheraton San Diego Hotel & Marina

Keynote speaker is Retired Master Sergeant Cedric King. Sessions focus on practical solutions for your business, including retaining today’s new workforce, buying or selling your agency, data transparency and alternative healthcare management. And there’s an expanded Medicare Extreme! with proven practices and important trends on changes in Medicare, technology solutions, growing your business with group Medicare sales plus more. Plus plenty of opportunity to visit with a variety of vendors and network with colleagues More info here.

Alliance of Comprehensive Planners 2019 Annual Conference

Nov. 12-15, Hyatt Regency Mission Bay, San Diego

The Alliance of Comprehensive Planners (ACP) is a community of tax-focused financial planners who provide planning strategies for clients on a fee-only retainer basis. Conference early bird registration rates (which expire Oct. 11, 2019) are in effect now. Participation is open to all interested financial professionals. Companies interested in sponsoring the ACP Annual Conference should contact Jill Colsch at jill@acplanners.org. The agenda is available here: https://2019.acplanners.org/home.