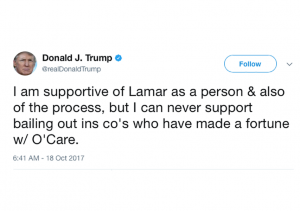

The Hill reported that President Trump on Wednesday suggested he will oppose a bipartisan deal to help stabilize the Affordable Care Act, reversing comments he made on Tuesday. Trump tweeted that he was “supportive” of Lamar Alexander (R-Tenn.), the deal’s architect, but said he would “never support bailing out” insurance companies, saying they “have made a fortune” under the Affordable Care Act.

We Live in Ridiculous Time, Insurance Folks

In the next issue of California Broker magazine, we’re taking a look at President Trump’s executive order. And, because we want to know how health care reform at a national level might impact the state, we’ve consulted a few of our long-time contributors who know California insurance better than anyone. Here’s how industry veteran Alan Katz starts his response:

“As it pertains to health care reform, we live in ridiculous times. Not interesting times. Not challenging times. Ridiculous times.

Think about it. The Patient Protection and Affordable Care Act passed in 2010. Traditionally (remember when American politics had traditions?), over the next several years the administration and Congress would fine-tune the legislation to clarify ambiguities and fix obvious errors. Lawmakers on both sides of the aisle would act to make it work. In the hyper-partisan world we now inhabit, very little of that happened.

Now President Donald Trump and Congressional Republicans have backed themselves into a corner. They need to pass health care reform, but seem incapable of passing anything.”

That’s just a taste. Don’t miss November’s print issue for the whole enchilada, including Katz and other experts weighing in on how health care reform will shakedown for California and what we should really be concerned about.

Welcome to CSRmageddon

The Washington Examiner, calling the situation CSRmageddon, reported that on the heels of the healthcare policy world trying to digest Trump’s recent executive order, Trump also announced that he no longer would continue making cost-sharing reduction payments under Obamacare. The Washington Examiner predicts that Trump’s move will fuel Democrats’ efforts to blame Republican “sabotage” for all of Obamacare’s problems going into the 2018 midterm elections. And it may turn the focus to bipartisan talks in Congress which could result in a decision to officially appropriate the payments. States are expected to sue for the funds, triggering the next high-stakes legal battle.

Covered California Adds Cost-Sharing Reduction Surcharge to Silver Plans

Covered California announced in early October the final rates for its health plans in 2018 and that there will be a surcharge on Silver-tier plans due to the ongoing uncertainty at the federal level. The surcharge is necessary because of a lack of commitment from the federal government to fund CSRs, according to Covered California. The average CSR surcharge increase on rates is 12.4 percent, although the surcharge will vary for each health insurance company and will range from 8 percent to 27 percent. However, because the surcharge is only being loaded onto Silver-tier plans, those who purchase coverage without getting federal help — whether through Covered California or by buying directly from health insurance companies — can be protected from paying the surcharge. Covered California says that most consumers who receive financial help in the form of an Advanced Premium Tax Credit, or subsidy, will not see a change in what they pay for their insurance in 2018 because of the surcharge, and many will actually end up paying less because their subsidy amount will increase more than the surcharge. “Covered California worked hard to come up with a plan that ensures a stable market and protects as many consumers as possible from an unnecessary price hike,” said Peter V. Lee, executive director of Covered California. “While some consumers will face higher costs than expected this year unrelated to the CSR surcharge, they can still shop for a better deal to reduce the impact of the surcharge.” A Covered California analysis on the impact of the CSR surcharge found that 78 percent of subsidized consumers would either see no change in what they would pay for insurance in 2018, or would pay less than what they would have paid if there had been no CSR surcharge. The remaining 22 percent will see some form of higher net premium because of the CSR surcharge, and about half of them will see increases of less than $25 per month. More information is available at Covered California’s website.

Number of Americans with Inadequate Health Coverage Rose Sharply in 2016

Twenty-eight percent of working-age adults with health coverage all year were underinsured in 2016, up from 23 percent in 2014, according to Commonwealth Fund’s 2016 Biennial Health Insurance Survey. People who are underinsured have high deductibles and high out-of-pocket expenses relative to their income. The report shows that more than half the underinsured had medical bill problems or medical debt, while nearly half went without needed health care because of cost. Underinsurance affects people with all types of health coverage, the researchers say. Since 2014, the share of people with employer coverage who are underinsured has sharply increased, particularly so for workers in larger companies. More than half the 41 million people estimated to be underinsured have their coverage through an employer. The Commonwealth Fund’s Sara Collins, lead author of the report, says the growing number of Americans who are underinsured is especially concerning “because those with the greatest need for affordable health care are most likely to be affected — people with low incomes and people with health problems.”

A.M. Best Offers Presentations From NYC Insurance Market Briefing

Don’t fret if you weren’t able to attend the Oct 11. A.M. Best market briefing in New York City. Best has now made audio and video of the briefing available online. Presentation slides are also available for download. At the conference, A.M. Best analysts delivered market insights, presented an overview of the state of the industry and discussed rating trends. Attendees heard in-depth discussion of relevant insurance industry topics from Best’s perspective. Analysts also presented updates on the recent changes to Best’s Credit Rating Methodology (BCRM) and the Best’s Capital Adequacy Ratio (BCAR) model. Sectors covered included life and annuity, reinsurance, insurance-linked securities and more.

HELP Committee Receives Testimony on Prescription Drugs

On Wednesday, the Senate Health, Education, Labor and Pensions (HELP) Committee had a hearing on the prescription drug distribution chain and its impact on patient costs. The Senior Care Pharmacy Coalition (SCPC) testified that any solution to address drug pricing issues related to the “multitude of pharmacy benefit manager pricing abuses” must address the entire drug pricing system, not just disparate links along the chain.

“A comprehensive full-spectrum solution is the only real option,” said Alan G. Rosenbloom, President and CEO of SCPC, a federal advocacy organization devoted to the interests of the nation’s LTC pharmacies and the patients they serve.

According to Rosenbloom, the overall system is “like a balloon – squeeze one area (e.g., DIR fees) and PBMs will employ new techniques or more aggressively employ existing ones (e.g., reduce payments even more by manipulating payment methodologies, increasing existing fees or creating new ones or ramping up already unduly aggressive audit practices). Piecemeal fixes will simply shift the problem from one part of the pricing system to another.”

The SCPC leader said that the nation’s three major PBMs — CVS Caremark, Express Scripts and Optum Rx — control more than 80 percent of prescriptions dispensed in America, and that for patients living in the nation’s LTC facilities, this percentage jumps to more than 90 percent. Read the organization’s full written testimony here.

In addition, Pharmaceutical Care Management Association (PCMA) President and CEO Mark Merritt also testified. Merritt said PBMs reduce prescription drug costs for consumers, employers, unions and government programs. PBMs typically reduce prescription drug costs by 30 percent by using scale and expertise to promote generics and negotiate aggressive rebates, discounts and other price concessions with drug manufacturers to reduce premiums and cost-sharing, he said. Read Merritt’s full testimony here.

Exton Becomes Managing Director at Venbrook

Los Angeles-based Venbrook recently announced the appointment of Lee Exton, CEBS, to managing director of employee benefits and total rewards. Venbrook is one of the largest independent insurance brokerage and services firms in the country. Venbrook says Exton will be instrumental in the company’s growth strategy for its benefits consulting practice. He will oversee all aspects of benefits and total rewards programs, and develop custom solutions to address unique business challenges.

LaBert Joins NAILBA as CEO

The National Association of Independent Life Brokerage Agencies (NAILBA) announced that Dan LaBert, former executive director of the National Association of Consumer Bankruptcy Attorneys (NACBA) has been named as the organization’s new Chief Executive Officer. LaBert will oversee the daily operations of NAILBA, and work with the board of directors to continue implementation of the association’s strategic plan while creating new membership experiences and value.

Bainbridge Named Senior Vice President at Voya

Voya Financial announced that Bill Bainbridge, FSA, MAAA, CERA has been appointed senior vice president and leader of all product development and in-force management for the company’s annuities and individual life businesses. He will oversee a team of more than 40 professionals and report to Carolyn Johnson, chief executive officer, Annuities and Individual Life.

#IICFWeekofGiving Oct 14-21!

Last year nearly 8,500 industry colleagues and friends participated in the Insurance Industry Charitable Foundation’s Week of Giving. This year you can too! Give your time, talent and resources to benefit your local community. Volunteer as an individual or as part of a company team or group from different companies. The week will be packed full of volunteering projects. If you have one hour, you can write cards and letters of appreciation to our service men and women from your office. If you have three or four hours, you can help at a food bank or shelter, read to preschoolers at an early literacy event, clean up a community park — or many other activities with local nonprofit organizations. Projects will take place in cities throughout the United States and United Kingdom. Explore projects and register to volunteer at www.weekofgiving.iicf.org New projects continue to be added.

Last year nearly 8,500 industry colleagues and friends participated in the Insurance Industry Charitable Foundation’s Week of Giving. This year you can too! Give your time, talent and resources to benefit your local community. Volunteer as an individual or as part of a company team or group from different companies. The week will be packed full of volunteering projects. If you have one hour, you can write cards and letters of appreciation to our service men and women from your office. If you have three or four hours, you can help at a food bank or shelter, read to preschoolers at an early literacy event, clean up a community park — or many other activities with local nonprofit organizations. Projects will take place in cities throughout the United States and United Kingdom. Explore projects and register to volunteer at www.weekofgiving.iicf.org New projects continue to be added.

LIMRA Annual Conference – Oct 22-24, National Harbor, Maryland.

The 2017 LIMRA annual conference will feature John Boehner, former speaker of the U.S. House of Representatives and John Brennan, former CIA director as general session speakers. Other sessions will address opportunities and strategies to better engage consumers through technology and Insurtech, marketing and distribution, and big data and data analytics. LIMRA also recently announced a CEO panel discussion with Thomas Marra, FSA, MAAA, chairman, president, and chief executive officer, Symetra Financial Corporation; Ted Mathas, chairman and chief executive officer, New York Life Insurance Company; Robert L. Reynolds, president and chief executive officer, Putnam Investments and Great-West Financial and Robert A. Kerzner, CLU, ChFC (moderator), president and chief executive officer, LIMRA, LOMA, and LL Global, Inc. For more info and registration go to LIMRA’s Annual Conference page.

Women in Insurance and Financial Services 30th Annual National Conference – Oct 25-27, Minneapolis

This year’s conference, Dream It Achieve It, will celebrate the impact that women are making in the insurance and financial services industry. The conference focuses on empowering women through dynamic educational workshops, networking events and inspirational sessions that help women invest in their futures. An additional element of this year’s conference is a featured session that provides attendees the opportunity to earn continuing education (CE) credits. The exhibit hall will host 50 vendors with products and services aimed at elevating the businesses of those in the industry. Workshop topics include marketing strategies, sustainable investing, Department of Labor policy, best practices, team building and more. Learn more and register at the WIFS conference page.

NAILBA 36 – Nov. 16-18, Hollywood, Florida

Registration is now open for the National Association of Independent Life Brokerage Agencies (NAILBA) 36th Annual Meeting, NAILBA 36. Scheduled November 16-18, 2017, at the Diplomat Beach Resort in Hollywood, Florida, the meeting will attract high level representatives from brokerage general agencies, life insurance carriers and insurance industry vendors. This year’s agenda has been expanded to deliver four keynote